I'm not really comfortable with this chapter (or the previous one although i should be able to cope with that on my own)

I'm looking at the various mapping methods... And i'm just a bit confused.

For example, The return var is a product of the modified duration and the yield var... how do i calculate the yield var? where does this number come from? (is it given?)

(as a side note: I'm also curious to know if we are expected to calculate the modified duration for the exam... i learned to do it for part 1 but it's very tedious work and would consume me more than 3 min)

furthermore the tracking error is stated as the deviation relative to the benchmark... however in question 5 of the reading it takes the active risk rather than the difference in volatility between benchmark and portfolio... i'm a bit confused as to why that is.

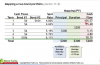

lastly we have the mapping for different products. Again, i'm a bit unsure where the var % comes from and how the correlation matrix figures into the calculation (is it for the componend var?) and if we even need to do the matrix calculation on the exam.

I'm inclined to reread these few chapters again since it's Jorion and i have a feeling it might be one of the more important chapters.

Thanks.

I'm looking at the various mapping methods... And i'm just a bit confused.

For example, The return var is a product of the modified duration and the yield var... how do i calculate the yield var? where does this number come from? (is it given?)

(as a side note: I'm also curious to know if we are expected to calculate the modified duration for the exam... i learned to do it for part 1 but it's very tedious work and would consume me more than 3 min)

furthermore the tracking error is stated as the deviation relative to the benchmark... however in question 5 of the reading it takes the active risk rather than the difference in volatility between benchmark and portfolio... i'm a bit confused as to why that is.

lastly we have the mapping for different products. Again, i'm a bit unsure where the var % comes from and how the correlation matrix figures into the calculation (is it for the componend var?) and if we even need to do the matrix calculation on the exam.

I'm inclined to reread these few chapters again since it's Jorion and i have a feeling it might be one of the more important chapters.

Thanks.