Steve Jobs

Active Member

Hi,

In FRM1, it was S+c = Ke + p

In FRM2, I found 2 practice questions:

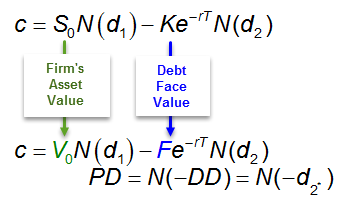

-In first question, the question gives the V for Value of firm, F for Face value debt, S for value of equity and then asking for p.

In the provided answer, the c is substituted with value of equity and p is calculated.

-In the second question, the value of c is given and then the question is asking for value of equity.

To calculate the value of equity, this formula used E=A-Dt which is understandable but not consistent with the answer provided for the first question; I though according to the first question c = value of equity.

Do you see the inconsistency?

In FRM1, it was S+c = Ke + p

In FRM2, I found 2 practice questions:

-In first question, the question gives the V for Value of firm, F for Face value debt, S for value of equity and then asking for p.

In the provided answer, the c is substituted with value of equity and p is calculated.

-In the second question, the value of c is given and then the question is asking for value of equity.

To calculate the value of equity, this formula used E=A-Dt which is understandable but not consistent with the answer provided for the first question; I though according to the first question c = value of equity.

Do you see the inconsistency?

).

).