Hi,

I have a question on the assumptions behind Yield-To-Maturity.

I have read the Yield-To-Maturity (YTM) chapter on the Tuckman (chapter 3 on my edition) that explains why YTM is a measure of the realized return to maturity of a bond. My understanding of the explanation is as follow:

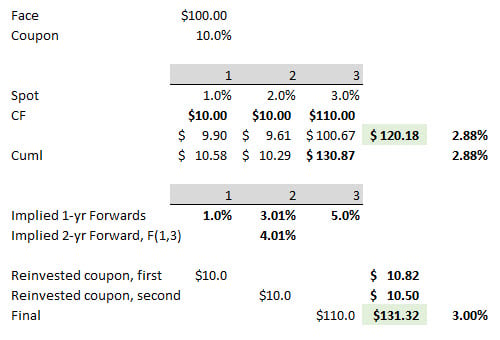

If every coupon received between now and maturity is reinvested at the YTM rate, at maturity, the future values of all these coupons + face value will be equal to the future value of the current price of the bond invested at the YTM rate. In other words, the YTM concept assumes that the prevailing rate in the market will be equal to YTM for the entire life of the bond.

My question is:

Is the concept of YTM consistent with the concept of implied forward curve?

In other words, does the YTM concept assumes that the 1 year rate in 1 year time will be equal to the current 1 year implied forward rate or does it assume that it will be equal to the current 1 year spot rate?

The no-arbitrage theory tells me that the prevailing rate in 1 year should be equal to current implied forward rate, hence how can I assume, as the YTM concept seems to do, that the prevailing rate remains the same for the entire life of the bond?

Thanks

I have a question on the assumptions behind Yield-To-Maturity.

I have read the Yield-To-Maturity (YTM) chapter on the Tuckman (chapter 3 on my edition) that explains why YTM is a measure of the realized return to maturity of a bond. My understanding of the explanation is as follow:

If every coupon received between now and maturity is reinvested at the YTM rate, at maturity, the future values of all these coupons + face value will be equal to the future value of the current price of the bond invested at the YTM rate. In other words, the YTM concept assumes that the prevailing rate in the market will be equal to YTM for the entire life of the bond.

My question is:

Is the concept of YTM consistent with the concept of implied forward curve?

In other words, does the YTM concept assumes that the 1 year rate in 1 year time will be equal to the current 1 year implied forward rate or does it assume that it will be equal to the current 1 year spot rate?

The no-arbitrage theory tells me that the prevailing rate in 1 year should be equal to current implied forward rate, hence how can I assume, as the YTM concept seems to do, that the prevailing rate remains the same for the entire life of the bond?

Thanks