You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Information Ratio

- Thread starter DShim27

- Start date

@DShim27 it would save time if, when you have a question like this, you do a quick search on "information ratio." Very searchable question. (it even has a tag: https://forum.bionicturtle.com/tags/information-ratio-2/). I recently wrote about a correction to GARP's material here at https://forum.bionicturtle.com/threads/problems-in-garps-2020-frm-material.23011/post-80564 i.e.,

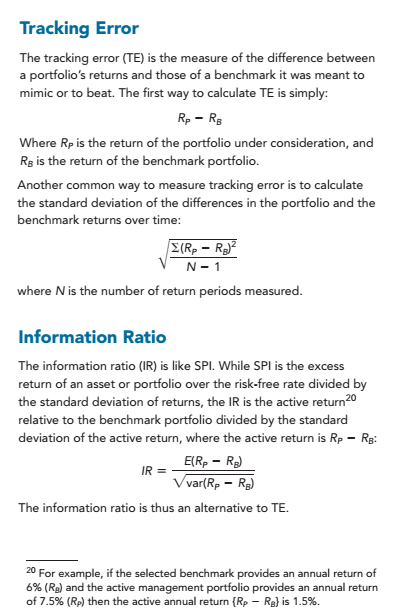

In FRM-5 (Modern Portfolio Theory, MPT, and the Capital Asset Pricing Model. CAPM), only one version of the information ratio is defined (see below). I have reminded GARP that the FRM needs to allow for two definitions of the information ratio; this has been the case in the FRM since 2012. Specifically, the new new 2020 text (Chapter 5, see below) defines only the active IR; i.e., IR = excess_ return ÷ active_risk. However,

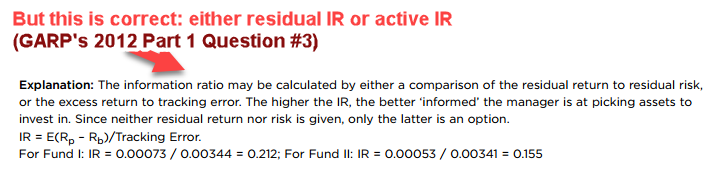

- In 2012, we pointed out that FRM-assigned authors Jorion/Bodie/Grinold implied different variations on the information ratio. I suggested the rule should be the principle of ratio consistency and ratio consistency allows for either an active IR or a residual IR. Helpfully, Question #3 in GARP's 2012 Practice Exam Part 1 was amended (see below) to clarify what has been the guidance ever since: "The information ratio may be calculated by either a comparison of the residual return to residual risk, or the excess return [dh note: i.e., active return] to tracking error [dh note: assume active risk, but clarification not needed in this case]."

For that discussion see https://forum.bionicturtle.com/threads/information-ratio-definition.5554/- Why does this matter? Because the more technical IR is the residual IR. If you run datasets, your are prone to correctly calculate alpha as the regression intercept. If you use this alpha (aka, residual return) and also enforce ratio consistency, your tracking error will be the residual version: IR = α/σ(α). In short, if you use a proper alpha and you enforce ratio consistency, residual IR is the correct version; active IR is more convenient because it is easier to calculate, is the trade-off.

- Here is another reason that the IR in Part 1 needs to be either residual/active: to be consistent with Part 2!

- Assigned Andrew Ang clearly defines IR as a residual IR.

- Also in Part 2, Bodie often defines IR as residual IR. See detailed discussion/interpretation of Bodie's alpha and tracking error here https://forum.bionicturtle.com/threads/unsystematic-risk-alpha.6993 and here https://forum.bionicturtle.com/threads/p2-t8-18-statistical-significance-of-alpha-bodie.5578

- Note on terminology where I will illustrate with an example: Rf = 3.0%, market portfolio's return = 9.0% (ie, market portfolio's excess return is 6.0%) and portfolio's beta, β(P,M) = 1.50. Although I'm using the CAPM to illustrate with the really simple single-factor case, keep in mind alpha/IR/TE are meant for more sophisticated multi-factor models:

- Active return is the portfolio's return in excess of the benchmark. In my example, if the Portfolio returns 14.0%, then active return is 14.0% - 9.0% = +5.0%.

- Residual return (aka, alpha) is the portfolio's return and and therefore adjusted by beta). In my example, alpha is 14.0% - 3.0% - (1.5 β * 6.0%) = +2.0%; we can might say alpha is the active return with respect to a risk-adjusted (beta-adjusted) benchmark, which can lead to the confusion. CAPM holds that expected (ex ante) alpha is zero; an ex post alpha is the regression's intercept

- Tracking error does suffers ambiguity; it can refer either to active risk, σ(Rp - Rb; ie, active return), or it can refer to residual risk,σ(α = alpha).

Similar threads

- Replies

- 2

- Views

- 330

- Replies

- 2

- Views

- 1K

- Replies

- 0

- Views

- 77