The below example is taken from Linda Allen

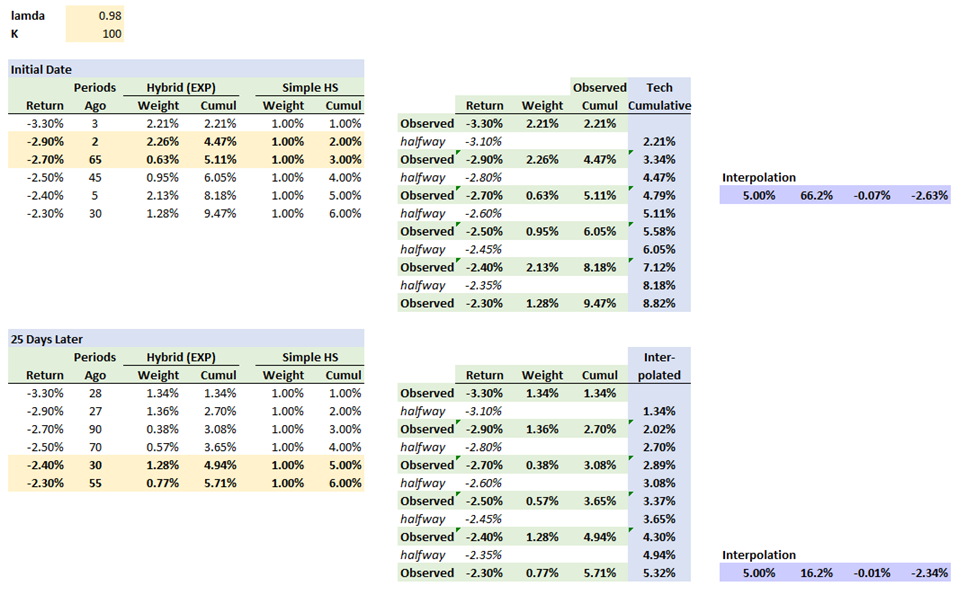

Order Return Periods Hybrid weight Hybrid cumul. weight HS weight HS cumul.ago weight

1 −3.30% 3 0.0221 0.0221 0.01 0.01

2 −2.90% 2 0.0226 0.0447 0.01 0.02

3 −2.70% 65 0.0063 0.0511 0.01 0.03

4 −2.50% 45 0.0095 0.0605 0.01 0.04

5 −2.40% 5 0.0213 0.0818 0.01 0.05

6 −2.30% 30 0.0128 0.0947 0.01 0.06

25 days later:

1 −3.30% 28 0.0134 0.0134 0.01 0.01

2 −2.90% 27 0.0136 0.0270 0.01 0.02

3 −2.70% 90 0.0038 0.0308 0.01 0.03

4 −2.50% 70 0.0057 0.0365 0.01 0.04

5 −2.40% 30 0.0128 0.0494 0.01 0.05

6 −2.30% 55 0.0077 0.0571 0.01 0.06

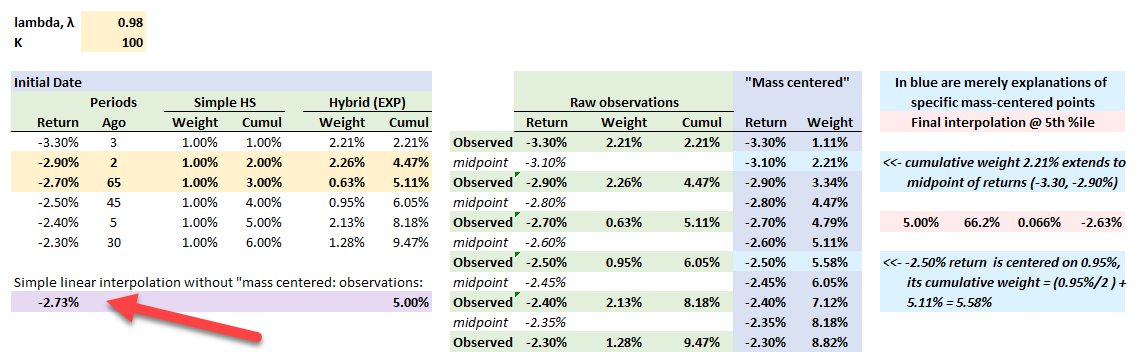

In the first case the VaR is computed as follows

2.80% − (2.80% − 2.70%)*[(0.05 − 0.0479)/(0.0511 − 0.0479)]

=2.73%

In the second case the VaR is computed as

2.35% − (2.35% − 2.30%)*[(0.05 − 0.0494)/(0.0533− 0.0494)]

=2.34%

Why is that in the first case, the author uses the average Hybrid Cumm. weight (0.0479) for returns -2.7% and -2.9% in the numerator, whereas in the second case, he uses the average Hybrid Cumm. weight (0.0533) for returns -2.4% and -2.3% in the denominator

Can you please clarify how we are supposed to compute the VaR using this approach ?

Are we just eyeballing the Hybrid Cumm. weights and picking those that are close to the 5% VaR and performing interpolation?

Thanks

Sundeep

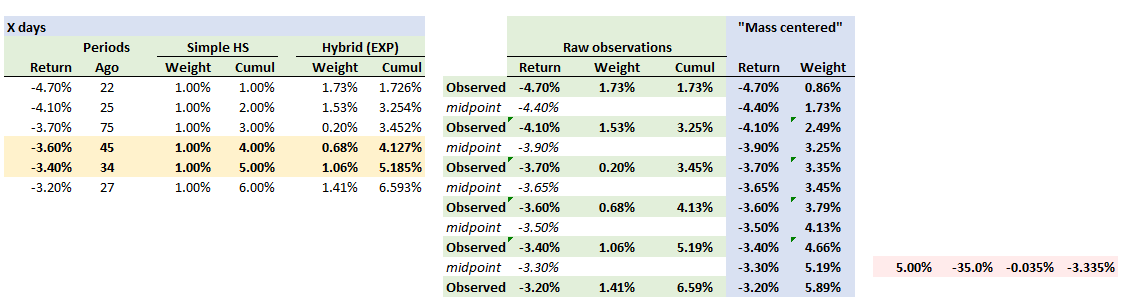

Order Return Periods Hybrid weight Hybrid cumul. weight HS weight HS cumul.ago weight

1 −3.30% 3 0.0221 0.0221 0.01 0.01

2 −2.90% 2 0.0226 0.0447 0.01 0.02

3 −2.70% 65 0.0063 0.0511 0.01 0.03

4 −2.50% 45 0.0095 0.0605 0.01 0.04

5 −2.40% 5 0.0213 0.0818 0.01 0.05

6 −2.30% 30 0.0128 0.0947 0.01 0.06

25 days later:

1 −3.30% 28 0.0134 0.0134 0.01 0.01

2 −2.90% 27 0.0136 0.0270 0.01 0.02

3 −2.70% 90 0.0038 0.0308 0.01 0.03

4 −2.50% 70 0.0057 0.0365 0.01 0.04

5 −2.40% 30 0.0128 0.0494 0.01 0.05

6 −2.30% 55 0.0077 0.0571 0.01 0.06

In the first case the VaR is computed as follows

2.80% − (2.80% − 2.70%)*[(0.05 − 0.0479)/(0.0511 − 0.0479)]

=2.73%

In the second case the VaR is computed as

2.35% − (2.35% − 2.30%)*[(0.05 − 0.0494)/(0.0533− 0.0494)]

=2.34%

Why is that in the first case, the author uses the average Hybrid Cumm. weight (0.0479) for returns -2.7% and -2.9% in the numerator, whereas in the second case, he uses the average Hybrid Cumm. weight (0.0533) for returns -2.4% and -2.3% in the denominator

Can you please clarify how we are supposed to compute the VaR using this approach ?

Are we just eyeballing the Hybrid Cumm. weights and picking those that are close to the 5% VaR and performing interpolation?

Thanks

Sundeep

. Thanks!

. Thanks!