You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

how to understand static options replication

- Thread starter bruce1976chen

- Start date

bruce1976chen

New Member

I have trouble understand this hedge strategy for up and out call option, can anyone help to explain the above?thank a lot! (by the way, to make sure i understand properly, is up and out call option can only exercise on the expiration date, and during the life of the option, it will exit automatically once the stock price touch the barrier 50)

I found the diagram confusing, so would be interested to know David's take on it.

The main bit of information to digest from this is that it is possible to replicate exotic options using a linear combination of vanilla options. A classic example is the use of a call spread (bull spread) with the strikes really close together to replicate a binary option. I used to work in interest rate structuring at an investment bank and I've seen that done in practice.

The main bit of information to digest from this is that it is possible to replicate exotic options using a linear combination of vanilla options. A classic example is the use of a call spread (bull spread) with the strikes really close together to replicate a binary option. I used to work in interest rate structuring at an investment bank and I've seen that done in practice.

Lu Shu Kai FRM

Well-Known Member

Dear @bruce1976chen ,

Hope this is not too late. Personally, I do not really like this diagram because it is different from the one we are used to, which is payoff vs asset price.

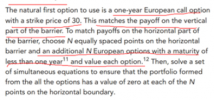

From your whole screenshot, I felt that this paragraph is the most important.

Basically, what the author is trying to say, is to replicate the payoff of the up-and-out barrier with a set of European options. This set of European options consists of (i) European option of strike 30 and maturity of one year and (ii) N European options of different maturities; all less than one year yet different from each other / unique. This is to ensure that the barrier payoff itself is replicated as mentioned in the text "horizontal boundary".

Once you have the set of European options / portfolio (created with static options replication), you can short it to provide the "perfect" hedge. I wrote perfect with quotes because it is not really a perfect hedge... I am sure as an aspiring risk professional you should know that no perfect hedges exist in the financial markets.

Hope this is not too late. Personally, I do not really like this diagram because it is different from the one we are used to, which is payoff vs asset price.

From your whole screenshot, I felt that this paragraph is the most important.

Basically, what the author is trying to say, is to replicate the payoff of the up-and-out barrier with a set of European options. This set of European options consists of (i) European option of strike 30 and maturity of one year and (ii) N European options of different maturities; all less than one year yet different from each other / unique. This is to ensure that the barrier payoff itself is replicated as mentioned in the text "horizontal boundary".

Once you have the set of European options / portfolio (created with static options replication), you can short it to provide the "perfect" hedge. I wrote perfect with quotes because it is not really a perfect hedge... I am sure as an aspiring risk professional you should know that no perfect hedges exist in the financial markets.

Similar threads

- Replies

- 2

- Views

- 428

- Replies

- 0

- Views

- 362

- Replies

- 2

- Views

- 660