laurel akin

New Member

I am so sorry to bother you but I really need help. Note: I am new to bonds, interest rates, forward rates .. etc.

In many examples ( for instance in Hull's book) I see something like this:

TTM Coupon Price

0.25 0 97.5

0.50 0 94.9

1.00 0 90.0

1.50 8 96.0

2.00 12 101.6

My question is ( i am a newbie): How do we know the price and the coupon rate of 1.5-year note? (As far as I know there is no 1.5-year bond in the US. ). Do we calculate this? (also 2.5, 3.5 .....)

I will be very grateful if somebody explains this to me.

In many examples ( for instance in Hull's book) I see something like this:

TTM Coupon Price

0.25 0 97.5

0.50 0 94.9

1.00 0 90.0

1.50 8 96.0

2.00 12 101.6

My question is ( i am a newbie): How do we know the price and the coupon rate of 1.5-year note? (As far as I know there is no 1.5-year bond in the US. ). Do we calculate this? (also 2.5, 3.5 .....)

I will be very grateful if somebody explains this to me.

(it gives me and Nicole a break from trying to translate Stulz writing into plain English

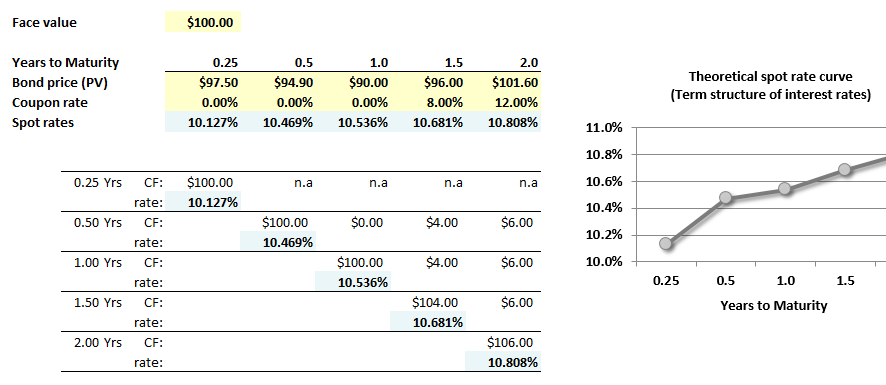

(it gives me and Nicole a break from trying to translate Stulz writing into plain English  ). As we are updating the Hull notes, I just recently revised this exhibit (I combined Table 4.3 and Table 4.4 below). Do you have Excel? If so, here is the sheet:

). As we are updating the Hull notes, I just recently revised this exhibit (I combined Table 4.3 and Table 4.4 below). Do you have Excel? If so, here is the sheet: