Unusualskill

Member

Hi David,

This is GARP Practice Exam 2017 Q36.

Bank A and Bank B are two competing investment banks that are calculating the 1-day 99% VaR for an at-the- money call on a non-dividend-paying stock with the following information:

• Current stock price: USD 120

• Estimated annual stock return volatility: 18%

• Current Black-Scholes-Merton option value: USD 5.20

• Option delta: 0.6

To compute VaR, Bank A uses the linear approximation method, while Bank B uses a Monte Carlo simulation method for full revaluation. Which bank will estimate a higher value for the 1-day 99% VaR?

A. Bank A

B. Bank B

C. Both will have the same VaR estimate

D. Insufficient information to determine

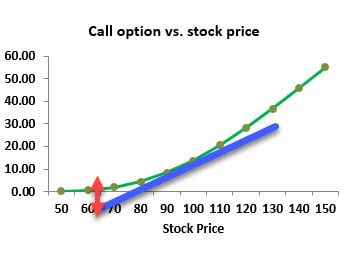

May I ask why linear approximation method(delta normal) will always give higher VaR than Monte Carlo? Thx!

This is GARP Practice Exam 2017 Q36.

Bank A and Bank B are two competing investment banks that are calculating the 1-day 99% VaR for an at-the- money call on a non-dividend-paying stock with the following information:

• Current stock price: USD 120

• Estimated annual stock return volatility: 18%

• Current Black-Scholes-Merton option value: USD 5.20

• Option delta: 0.6

To compute VaR, Bank A uses the linear approximation method, while Bank B uses a Monte Carlo simulation method for full revaluation. Which bank will estimate a higher value for the 1-day 99% VaR?

A. Bank A

B. Bank B

C. Both will have the same VaR estimate

D. Insufficient information to determine

May I ask why linear approximation method(delta normal) will always give higher VaR than Monte Carlo? Thx!