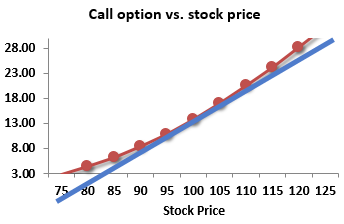

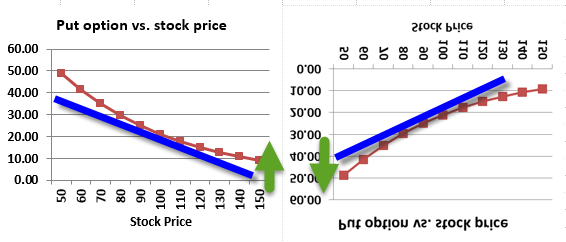

Bank A and B are both calculating 1 day 99% VAR for ATM no dividend call

A is using linear approx method

B is using monte carlo simulation for full revaluation

Stock price USD 120

Annual return volatility 18%

Current BSM option value 5.2USD

Option Delta 0.6

Which bank will have a higher 1 day 99% VAR

The ans is Bank A

But i dont quite understand why. Would you be able to explain?

A is using linear approx method

B is using monte carlo simulation for full revaluation

Stock price USD 120

Annual return volatility 18%

Current BSM option value 5.2USD

Option Delta 0.6

Which bank will have a higher 1 day 99% VAR

The ans is Bank A

But i dont quite understand why. Would you be able to explain?