As this question shown as example of value of a stock index forward contract:

Question:

The price a 6-month forward contract for which the underlying asset is a stock index with a value of 1,000 and a continuous dividend yield of 1%. Compute the value of a long position of the index increase to 1,050 immediately after the contract is purchase.

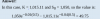

the answer given is:

My question is, why 1,050 only discounted for dividend yields, while 1,015 needs to discounted as RFR and Dividends

Thank you

Question:

The price a 6-month forward contract for which the underlying asset is a stock index with a value of 1,000 and a continuous dividend yield of 1%. Compute the value of a long position of the index increase to 1,050 immediately after the contract is purchase.

the answer given is:

My question is, why 1,050 only discounted for dividend yields, while 1,015 needs to discounted as RFR and Dividends

Thank you

Last edited: