[email protected]

New Member

Hi David,

I hope you are well.

On an interview I was asked what is the sensitivity of the Sharpe's ratio to the volatility,

The interviewer told it is almost zero...

Could you give a hint please?

Many thanks,

Indira

I hope you are well.

On an interview I was asked what is the sensitivity of the Sharpe's ratio to the volatility,

The interviewer told it is almost zero...

Could you give a hint please?

Many thanks,

Indira

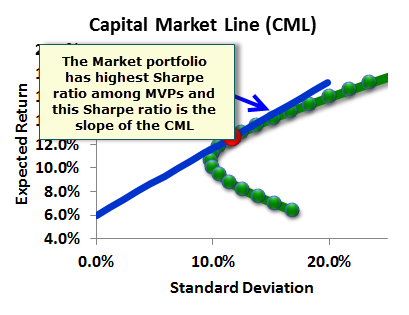

) in his first few lines, the Sharpe ratio of a (perfectly) diversified portfolio is equal to the Sharpe ratio of the market portfolio. This is a key feature of the capital market line (CML): unlike the SML, all points (portfolios) on the CML, which includes the Market Portfolio, are efficient with identical Sharpe ratios which correspond to the slope of the CML:

) in his first few lines, the Sharpe ratio of a (perfectly) diversified portfolio is equal to the Sharpe ratio of the market portfolio. This is a key feature of the capital market line (CML): unlike the SML, all points (portfolios) on the CML, which includes the Market Portfolio, are efficient with identical Sharpe ratios which correspond to the slope of the CML: