Shazam023

New Member

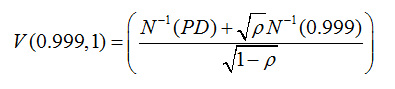

i just gone through Vasicek model for "Worst Case Default Rate"

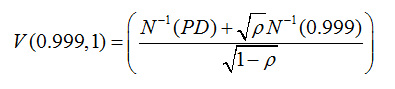

and the formula says:-

in most of the cases X= 99.1% and N= 1 year.

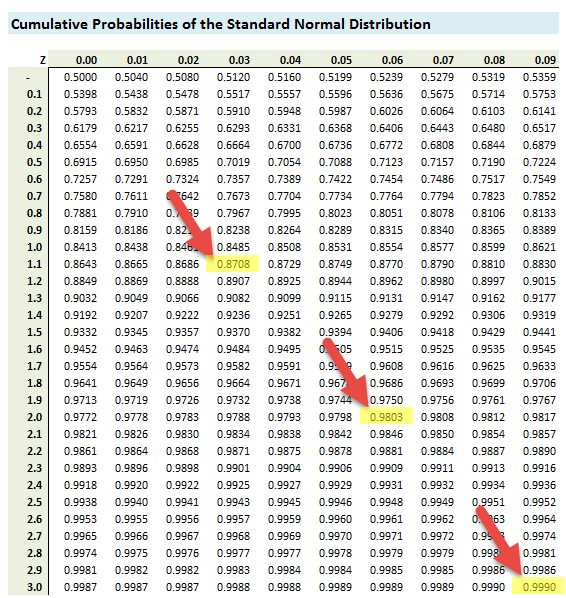

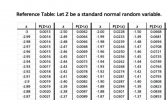

the issue is i'm not able to get the of N^-1 ?? how to solve this??

Ques:

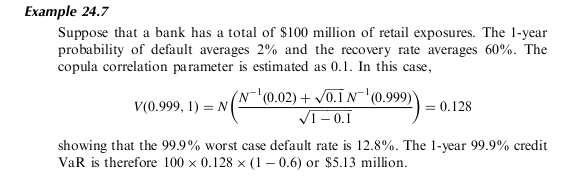

Suppose that a bank has a total of $100 million of retail exposures of varying sizes with each exposure being small in relation to

the total exposure. The one-year probability of default for each loan is 2% and the loss given default for each loan is 40%. The

copula correlation parameter, is estimated as 0.1.

Answer: WCDR (0.999,1)= 0.128

i'm not getting this 0128

please help

and the formula says:-

in most of the cases X= 99.1% and N= 1 year.

the issue is i'm not able to get the of N^-1 ?? how to solve this??

Ques:

Suppose that a bank has a total of $100 million of retail exposures of varying sizes with each exposure being small in relation to

the total exposure. The one-year probability of default for each loan is 2% and the loss given default for each loan is 40%. The

copula correlation parameter, is estimated as 0.1.

Answer: WCDR (0.999,1)= 0.128

i'm not getting this 0128

please help