Hi David,

I am referring to question 06.11 in the exercises, it is one of the hardest questions in the Hull questions.

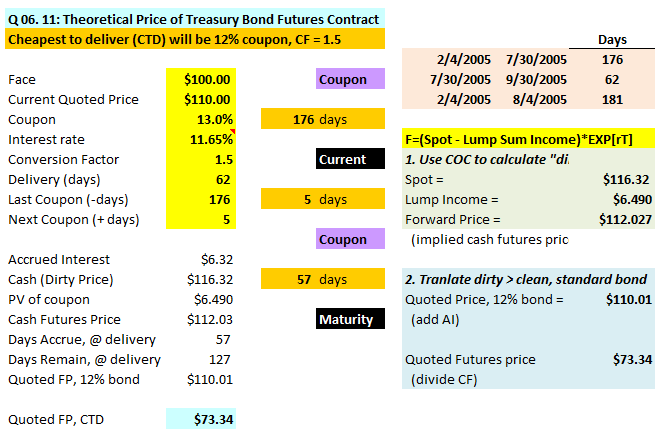

It is July 30, 2005. The cheapest-to-deliver bond in a September 2005 Treasury bond futures contract is a 13% coupon bond, and delivery is expected to be made on September 30th, 2005. Coupon payments on the bond are made on February 4 and August 4 each year. The term structure is flat, and the rate of interest with semiannual compounding is 12% per annum. The conversion factor for the bond is 1.5. The current quoted bond price is $110. Calculate the quoted futures price for the contract.

I understand how to get to the dirty price at 30 July: it is adding up accrued interest up to 30 July to the quoted (clean price of 110) subtract the present value of payment of coupon in 5 days (Augsut 4) to get to a dirty price of 112.028 at July 30.

I don't understand the last step where the accrued interest 6.5*(57/184) is subtracted from 112.028 to get a clean price. In the first place I don understand how this future accrued interest of (6.5*(57/184)) sneaked into the current dirty price of 112.08?

Thanks

I am referring to question 06.11 in the exercises, it is one of the hardest questions in the Hull questions.

It is July 30, 2005. The cheapest-to-deliver bond in a September 2005 Treasury bond futures contract is a 13% coupon bond, and delivery is expected to be made on September 30th, 2005. Coupon payments on the bond are made on February 4 and August 4 each year. The term structure is flat, and the rate of interest with semiannual compounding is 12% per annum. The conversion factor for the bond is 1.5. The current quoted bond price is $110. Calculate the quoted futures price for the contract.

I understand how to get to the dirty price at 30 July: it is adding up accrued interest up to 30 July to the quoted (clean price of 110) subtract the present value of payment of coupon in 5 days (Augsut 4) to get to a dirty price of 112.028 at July 30.

I don't understand the last step where the accrued interest 6.5*(57/184) is subtracted from 112.028 to get a clean price. In the first place I don understand how this future accrued interest of (6.5*(57/184)) sneaked into the current dirty price of 112.08?

Thanks