Thanks @Nicole Seaman

Hi @David Harper CFA FRM

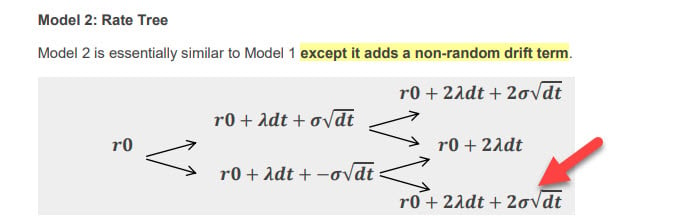

This one isn't an error per se, but when you eventually revisit R39-P2-T5-Tuckman Study Notes it would be helpful if you could number the formulae since the explanation refers to a bunch of formula numbers which are hard to follow since the fomulae themselves aren't numbered.

Screenshot example from page 26 on the CMT swap:

Thanks

Karim

Hi @David Harper CFA FRM

This one isn't an error per se, but when you eventually revisit R39-P2-T5-Tuckman Study Notes it would be helpful if you could number the formulae since the explanation refers to a bunch of formula numbers which are hard to follow since the fomulae themselves aren't numbered.

Screenshot example from page 26 on the CMT swap:

Thanks

Karim