Hi,

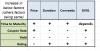

I tried to capture the effect of factors on Bond metrics. See below. Can anyone please verify whether following is correct?

Apologies, as exam is nearing I am feeling pressured for time and hence spared to do extensive forum search.

"+" --> Increase "-"--> Decrease

Please mention the quadrant that has problem...

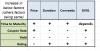

I tried to capture the effect of factors on Bond metrics. See below. Can anyone please verify whether following is correct?

Apologies, as exam is nearing I am feeling pressured for time and hence spared to do extensive forum search.

"+" --> Increase "-"--> Decrease

Please mention the quadrant that has problem...