SamuelMartin

New Member

I have issues understanding the result of the following question:

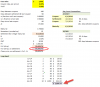

A $1,000 par corporate bond carries a coupon rate of 6%, pays coupons semiannually, and has ten coupon payments remaining to maturity. Market rates are currently 5%. There are 90 days between settlement and the next coupon payment. The dirty and clean prices of the bond, respectively are closest to:

a. $1,043.76, $1013.76

b. $1,043.76, $1028.76

c. $1,056.73, $1041.73

d. $1,069.70, $1054.70

The answer is c. However, in the explanation it says: The dirty price of the cond is calculated as N=10; I/Y=2.5; PMT=30; FV=1,000; PV=1,043.76

What is the formula applied here to come up with PV=1,043.76?

THANK YOU SO MUCH!!!!

A $1,000 par corporate bond carries a coupon rate of 6%, pays coupons semiannually, and has ten coupon payments remaining to maturity. Market rates are currently 5%. There are 90 days between settlement and the next coupon payment. The dirty and clean prices of the bond, respectively are closest to:

a. $1,043.76, $1013.76

b. $1,043.76, $1028.76

c. $1,056.73, $1041.73

d. $1,069.70, $1054.70

The answer is c. However, in the explanation it says: The dirty price of the cond is calculated as N=10; I/Y=2.5; PMT=30; FV=1,000; PV=1,043.76

What is the formula applied here to come up with PV=1,043.76?

THANK YOU SO MUCH!!!!