Hi all,

I think I have an interesting question:

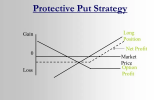

If we are long a put and long a stock (so that we are delta neutral) then we are long gamma and, both if the stock increase or decrease, our portfolio get a final positive value. Based on this (surely superficial) view, it seems that this portfolio is not arbitrage free since we always have a gain. Clearly there is something that i'm missing. What's your thought about this? @lushukai, @David Harper CFA FRM could I ask you where is the flaw in this thought?

I think I have an interesting question:

If we are long a put and long a stock (so that we are delta neutral) then we are long gamma and, both if the stock increase or decrease, our portfolio get a final positive value. Based on this (surely superficial) view, it seems that this portfolio is not arbitrage free since we always have a gain. Clearly there is something that i'm missing. What's your thought about this? @lushukai, @David Harper CFA FRM could I ask you where is the flaw in this thought?