I am reading de Servigny's Default Risk Quantitative Methodologies chapter from the GARP printed textbooks.

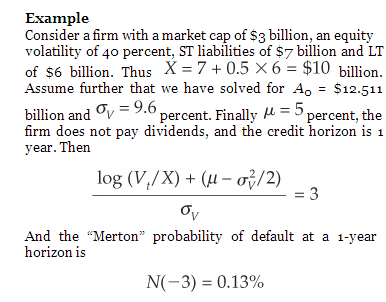

Page 69 references the Black-Scholes pricing model for the value of a firm's equity under the Merton model.

Interestingly, the formula does not reference d1 yet the expression is immediately followed by a "where d1 = ..." statement.

Does any know if this is a careless GARP error or does the actual de Servigny text also have the same error?

Obviously, we recognize d1 from the Black-Scholes model.

Best,

Brian

Page 69 references the Black-Scholes pricing model for the value of a firm's equity under the Merton model.

Interestingly, the formula does not reference d1 yet the expression is immediately followed by a "where d1 = ..." statement.

Does any know if this is a careless GARP error or does the actual de Servigny text also have the same error?

Obviously, we recognize d1 from the Black-Scholes model.

Best,

Brian

He could have indicated that the base was e.

He could have indicated that the base was e.