Sunil Natarajan

Credit Analyst

Hi David,

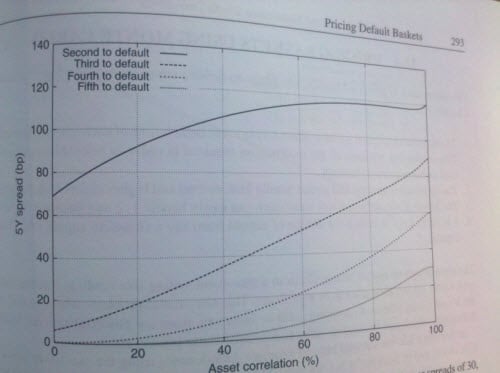

I have a small doubt about correlation in Nth default swap.In chapter 22 of Jorion (page 504) he mentions that type of protection depends upon correlation between credit events(is he referring credit events to default).Lower the correlation more expensive the swap(higher cost of protection) and vice versa. Does this imply basket swap premium is higher with low correlation of default? He then mentions in the next para that when N is large the higher default correlation would lead to higher cost of protection. It seems contradicting to me.

I have a doubt please correct me if Iam wrong CDS is more of an option as compared to it being a swap. The reason that the CDS seller (protection buyer) makes regular payment to CDS buyer (protection seller) until a credit event happens. The TROR is more of a swap as payments are made by both the parties simultaneously and also it covers economic risk (including fluctuation in market interest rates).

Regards,

Sunil

I have a small doubt about correlation in Nth default swap.In chapter 22 of Jorion (page 504) he mentions that type of protection depends upon correlation between credit events(is he referring credit events to default).Lower the correlation more expensive the swap(higher cost of protection) and vice versa. Does this imply basket swap premium is higher with low correlation of default? He then mentions in the next para that when N is large the higher default correlation would lead to higher cost of protection. It seems contradicting to me.

I have a doubt please correct me if Iam wrong CDS is more of an option as compared to it being a swap. The reason that the CDS seller (protection buyer) makes regular payment to CDS buyer (protection seller) until a credit event happens. The TROR is more of a swap as payments are made by both the parties simultaneously and also it covers economic risk (including fluctuation in market interest rates).

Regards,

Sunil