hellohi

Active Member

Dear @David Harper CFA FRM

in the original reading of "Mortgages and Mortgages-Backed Securities" Tuckman wrote this paragraph related to "Constant maturity mortgage (CMM)" as a product other than MBS (under "Other Products" title in the original reading), and mentiond "Convexity-free" and I did not understand what "Convexity-free" means, the paragraph text is as follows:

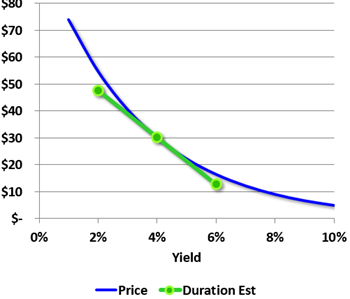

"Constant maturity mortgage (CMM) products allow investors to trade mortgage rates directly as a convexity-free alternative to trading prices of MBS that depend on the mortgage rate"

thanks Boss

Nabil

in the original reading of "Mortgages and Mortgages-Backed Securities" Tuckman wrote this paragraph related to "Constant maturity mortgage (CMM)" as a product other than MBS (under "Other Products" title in the original reading), and mentiond "Convexity-free" and I did not understand what "Convexity-free" means, the paragraph text is as follows:

"Constant maturity mortgage (CMM) products allow investors to trade mortgage rates directly as a convexity-free alternative to trading prices of MBS that depend on the mortgage rate"

thanks Boss

Nabil

I fixed those above to avoid confusion. Thank you twice!

I fixed those above to avoid confusion. Thank you twice!