HI @flex

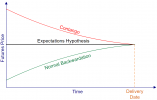

The second instance is simply the cost of carry model that determines a theoretical futures price based on the current spot price, S(0): Theoretical F(0) = S(0)*exp[(r+u-y)*T)]

The first instance, Theoretical F(0) = E[S(t)]*exp[(r-k)*T]. relate the same theoretical futures price, F(0), to the expected future spot price, E[S(t)]. The expected future spot price, E[S(t)], is unobserved and unknown with any certainty. But my model needs to show that the theoretical futures price is the same under either approach in order to be internally coherent. Thanks,

The second instance is simply the cost of carry model that determines a theoretical futures price based on the current spot price, S(0): Theoretical F(0) = S(0)*exp[(r+u-y)*T)]

The first instance, Theoretical F(0) = E[S(t)]*exp[(r-k)*T]. relate the same theoretical futures price, F(0), to the expected future spot price, E[S(t)]. The expected future spot price, E[S(t)], is unobserved and unknown with any certainty. But my model needs to show that the theoretical futures price is the same under either approach in order to be internally coherent. Thanks,