You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Computing delta of an ATM call using N(d1)

- Thread starter hateeque

- Start date

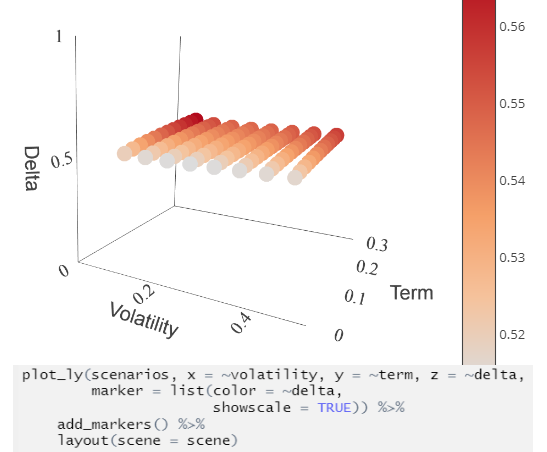

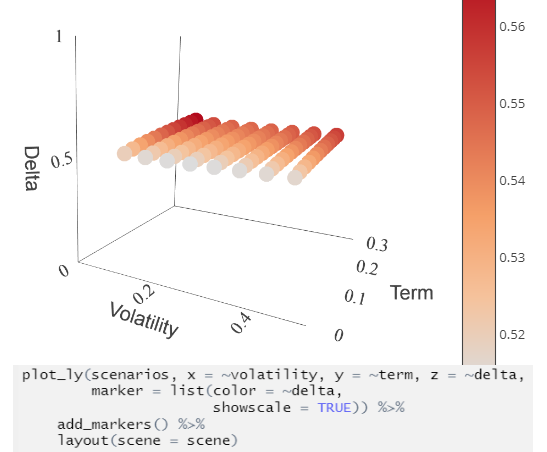

Hi @hateeque It's generally okay conditional on a short-term option. I am practicing my rstats today, so I generated this plot that shows the delta for an at-the-money call option, but the term only goes up to 12 weeks. After three months, delta tends to round nearer to 0.6. Thanks

Similar threads

- Replies

- 3

- Views

- 512

- Replies

- 0

- Views

- 487

- Replies

- 0

- Views

- 473

- Replies

- 0

- Views

- 600