Hi david

In calculating the size of up move factor U wat does square root of t mean is it time to maturity or the length of the step in the binomial model.

for example to calculate the value of a 6 month american call option using a 2 step binomial model wat will be the t value taken here to calculate U.

THANKS.

In calculating the size of up move factor U wat does square root of t mean is it time to maturity or the length of the step in the binomial model.

for example to calculate the value of a 6 month american call option using a 2 step binomial model wat will be the t value taken here to calculate U.

THANKS.

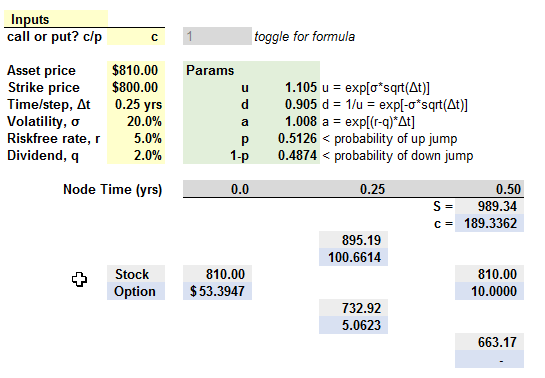

In case you want to see it "in action," I pulled out the above example (from the learning XLS) to a single sheet here at

In case you want to see it "in action," I pulled out the above example (from the learning XLS) to a single sheet here at

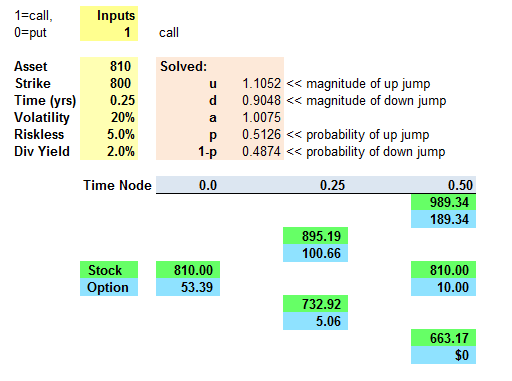

I just happen to be currently revising these binomial exhibits, I think they look better (eg, including some formulas in the exhibit):

I just happen to be currently revising these binomial exhibits, I think they look better (eg, including some formulas in the exhibit):