hawayi_vgo

New Member

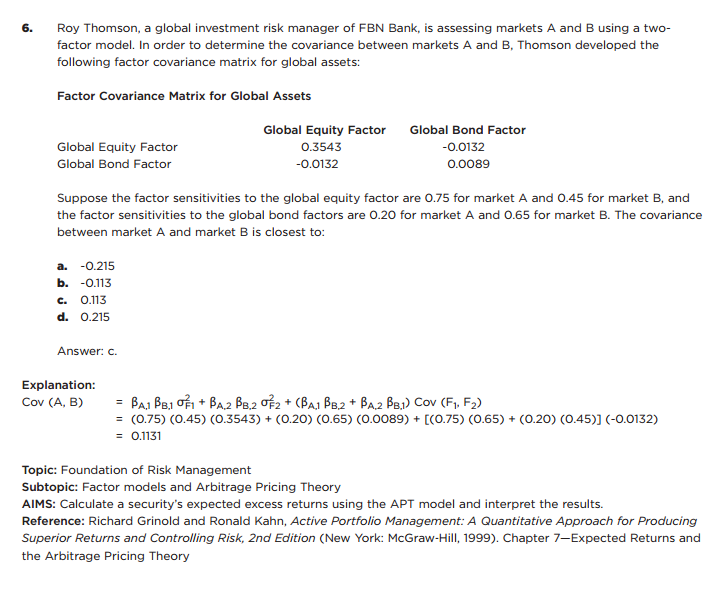

63.2. Your colleague Robert uses a two-factor model in order to estimate the volatility of a Portfolio. He specifies the covariance matrix as follows:

equity factor, bond factor

equity factor 0.09, 0.072

bond factor 0.072, 0.16

The Portfolio has the following factor sensitivities (i.e., betas): 0.60 to the Global Equity Factor and 0.25 to the Global Bond Factor. The volatility of the Portfolio is nearest to which value?

The answer:

Variance(Portfolio) = 0.60^2*0.090 + 0.25^2*0.160 + 2*0.60*0.25*0.0720

Are we using beta as asset's weight?

Are they the same?

Thank you!

equity factor, bond factor

equity factor 0.09, 0.072

bond factor 0.072, 0.16

The Portfolio has the following factor sensitivities (i.e., betas): 0.60 to the Global Equity Factor and 0.25 to the Global Bond Factor. The volatility of the Portfolio is nearest to which value?

The answer:

Variance(Portfolio) = 0.60^2*0.090 + 0.25^2*0.160 + 2*0.60*0.25*0.0720

Are we using beta as asset's weight?

Are they the same?

Thank you!