Unusualskill

Member

Hi @David Harper CFA FRM ,

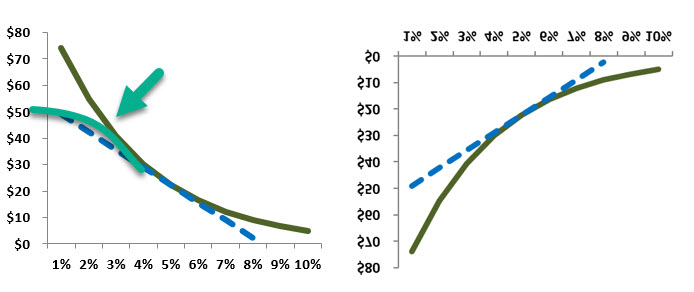

May I ask why when manager believes that rates will be especially volatile, barbell portfolio would be preferred over bullet portfolio?

As I know that barbell portfolio has greater convexity? then it means that price changes will be larger. But if thats the case, the price decline will also be larger? Please clarify.

Thank you so much!

May I ask why when manager believes that rates will be especially volatile, barbell portfolio would be preferred over bullet portfolio?

As I know that barbell portfolio has greater convexity? then it means that price changes will be larger. But if thats the case, the price decline will also be larger? Please clarify.

Thank you so much!