flawless21

Member

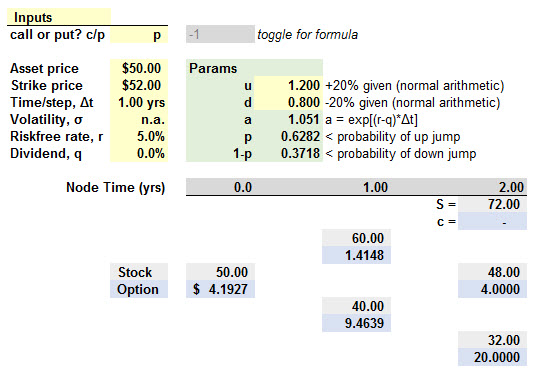

Hi David! I was looking at your video labeled: Hull, Options, Futures & Other Derivatives, Chapter 13: Binomial Trees. Can you help me with your backward induction formulas. For a point of reference, please go to 28:34 of your lecture.

I understand all the numbers at the second node, its the discounting that is throwing me off.

Q1: For example, to get to 1.4148, I see that you do (4*.3718) which is 1.4872. 1.4872 * e(-1*.05) = 1.4146 which is what you have in node 1. Why are we using the probability of a down jump to calculate at node 1? We are calculating the probability of going from a price of 48 to 60 - therefore shouldn't it be P(up jump)? Or are we using .3718 because we are looking at a put value, and the probability of a down jump would be negative if the price went from 48->60?

Q2: I am unable to get 9.4639 or 4.1927. Can you please share your calculation? I would imagine regarding 9.4639, you would do (4*.6282) + (20*.3718) = 14.410. 14.410*e(-1*.05) = 13.70.

Q3: Can you explain again what the "a" (1.051) variable means in a binomial tree?

Thanks so much!

I understand all the numbers at the second node, its the discounting that is throwing me off.

Q1: For example, to get to 1.4148, I see that you do (4*.3718) which is 1.4872. 1.4872 * e(-1*.05) = 1.4146 which is what you have in node 1. Why are we using the probability of a down jump to calculate at node 1? We are calculating the probability of going from a price of 48 to 60 - therefore shouldn't it be P(up jump)? Or are we using .3718 because we are looking at a put value, and the probability of a down jump would be negative if the price went from 48->60?

Q2: I am unable to get 9.4639 or 4.1927. Can you please share your calculation? I would imagine regarding 9.4639, you would do (4*.6282) + (20*.3718) = 14.410. 14.410*e(-1*.05) = 13.70.

Q3: Can you explain again what the "a" (1.051) variable means in a binomial tree?

Thanks so much!

). Somebody else posted a great intuition here on the forum about the (a) in the binomial, where I learned something, beyond the obvious (that it informs the p) I will see if i can find it tomorrow if that's okay? Thanks!

). Somebody else posted a great intuition here on the forum about the (a) in the binomial, where I learned something, beyond the obvious (that it informs the p) I will see if i can find it tomorrow if that's okay? Thanks!