FRM Exam (week ending 4/24)

Key definitions

Risk (general risk-related news that I find relevant, or just interesting ... )

Risk perception

Key definitions

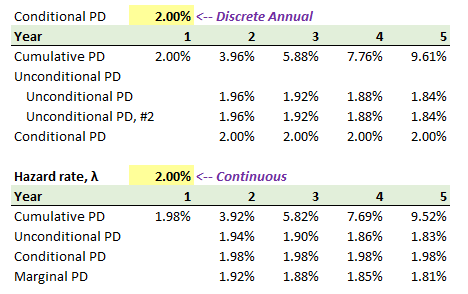

- @Kavita.bhangdia asks a good question about the challenging semantics of conditional (versus unconditional) default probability https://forum.bionicturtle.com/threads/computing-default-probability.9504/

- @QuantMan2318 explains drift in the calculation of EE and PFE for a normal distribution https://forum.bionicturtle.com/thre...-credit-exposure-gregory-5-1.7229/#post-41620

- @Tril asks, What exactly does Tuckman mean when he says the fixed income position is a “substantial 5-30 steepener?” https://forum.bionicturtle.com/thre...positions-with-key-rates-tuckman-3rd-ed.6963/

- @kik92 asks, What exactly are "risk interactions" and why are they a key theme in modern risk? https://forum.bionicturtle.com/threads/downs-in-risk-management.9499/

- @Kavita.bhangdia asks, Is IR = alpha/volatility of tracking error https://forum.bionicturtle.com/threads/tracking-error.9495/

- @QuantMan2318 explains risk measures vs. risk control vs. risk factors https://forum.bionicturtle.com/thre...isk-controls-vs-risk-factors.9491/#post-41672

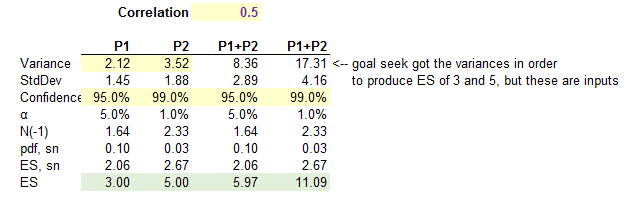

- @Kavita.bhangdia asks, Is ES additive (in a way similar to VaR)? https://forum.bionicturtle.com/threads/var-and-es.9497/

- How do we retrieve the VaR of a portfolio of bonds? https://forum.bionicturtle.com/threads/p1-t4-28-value-at-risk-var.5669/page-3#post-41626 And, what is the 99.0% VaR of a single bond with a default probability of 0.01? It is ambiguous. Valid answers include zero (consistent with Jorion), one (consistent with Dowd), and 0.50 (utilizing the hybrid-type approach which treats each observation as a random variable)

- @bpdulog shows absolute VaR with time scaling https://forum.bionicturtle.com/thre...ersus-relative-var-versus-ul.6020/#post-41645

- @brian.field asks a non-trivial question, can a derivative counterparty force bankruptcy? https://forum.bionicturtle.com/threads/failure-to-deliver-cds-physical-settlement.9467/

- @brian.field reminds us that the government had a role in sub-prime mortgage crisis (e.g., Community Reinvestment Act) https://forum.bionicturtle.com/threads/slipping-standards-in-subprime-lending-crouhy.9502/

- Should the CRO report to business line management? https://forum.bionicturtle.com/thre...governance-crouhy-galai-mark.8225/#post-41712

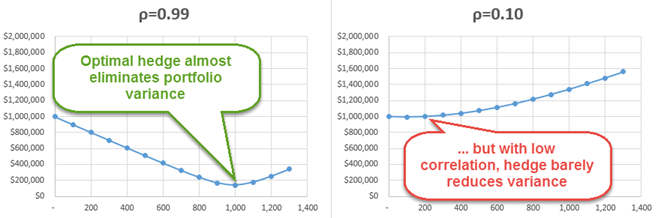

- To hedge a commodity position, do we prefer low or high correlation (illustrated) https://forum.bionicturtle.com/threads/optimal-hedge-ratio-correlation-understanding.9482/

- @nissark illustrates the effect of convexity adjustment on delta normal VaR https://forum.bionicturtle.com/thre...amma-value-at-risk-var.7203/page-3#post-41702

- @bpdulog asks, Do you need to know calculus for the FRM exam? https://forum.bionicturtle.com/thre...-density-functions-pdf.6783/page-2#post-41635

- @soubhg01 gets the FRM Designation! https://forum.bionicturtle.com/thre...t-2-frm-exam-feedback.9165/page-19#post-41703

- Author Jon Gregory gets high praise for his contributions to the FRM syllabus https://forum.bionicturtle.com/threads/wrong-way-risk-gregory.9501/

- The role of marginal VaR in reducing the Portfolio VaR and/or optimizing the portfolio: We think this question is answered incorrectly https://forum.bionicturtle.com/threads/optimum-portfolio-and-var-based-on-mvar.9485/

- Slightly different version of Malz w.r.t. Merton model equations https://forum.bionicturtle.com/threads/p2-t6-305-credit-value-at-risk-cvar.6816/page-2#post-41677

Risk (general risk-related news that I find relevant, or just interesting ... )

Risk perception

- How Information Graphics Reveal Your Brain’s Blind Spots http://linkis.com/www.propublica.org/a/aVj0e

- Risk aversion is a two-way street http://andrewgelman.com/2016/04/24/risk-aversion-is-a-two-way-street/

- Know This First: Risk Perception Is Always Irrational http://undark.org/article/know-this-first-risk-perception-is-always-irrational/ “The affect heuristic is a a mental shortcut that allows people to make decisions and solve problems quickly and efficiently, in which current emotion—fear, pleasure, surprise, etc.—influences decisions.” (https://en.wikipedia.org/wiki/Affect_heuristic)

- Make Better Decisions With Bayesian Probability, the Smart Way to Consider Risk https://www.inverse.com/article/144...an-probability-the-smart-way-to-consider-risk

- Enterprise Value (EV) & Calculating Enterprise Value Ratios http://www.arborinvestmentplanner.com/enterprise-value-ev-calculating-enterprise-value-ratios/

- Great lessons from Theranos by Jeffrey Carter: The Danger of Theranos http://pointsandfigures.com/2016/04/20/the-danger-of-theranos/ “Investing in highly technical companies is hard … Science isn’t like finance” This debacle continues to fascinate me, see latest: Theranos Is Subject of Criminal Probe by U.S. http://www.wsj.com/articles/theranos-is-subject-of-criminal-probe-by-u-s-1461019055

- Tech Companies Face Greater Scrutiny for Paying Workers With Stock http://www.nytimes.com/2016/04/18/t...r-scrutiny-for-paying-workers-with-stock.html

- FinTech: New Regulatory Developments https://corpgov.law.harvard.edu/2016/04/17/fintech-new-regulatory-developments/

- What’s next for personal financial services? http://techcrunch.com/2016/04/23/whats-next-for-personal-financial-services “Increasingly, the immediate accessibility to a variety of data sources is leading data-driven approaches to valuing and underwriting risk for lenders.

- Citi GPS: Digital Disruption, How FinTech is Forcing Banking to a Tipping Point https://www.citivelocity.com/citigps/ReportSeries.action?recordId=51

- The Financial Threats That Machines Can See http://www.bloombergview.com/articles/2016-04-18/the-financial-threats-that-machines-can-see

- Loans for Weddings: Fintech Learns to Focus http://www.wsj.com/articles/new-fintech-lenders-narrow-their-scope-1461193681

- New Rules Curbing Wall Street Pay Proposed http://www.wsj.com/articles/new-rules-curbing-wall-street-pay-announced-1461247600

- U.S. Regulators to Focus on Borrowing at Large Hedge Funds http://www.wsj.com/articles/u-s-reg...wing-at-large-hedge-funds-lew-says-1461015212

- Replacing Credit Ratings in Financial Regulation https://financialresearch.gov/from-the-management-team/2016/04/21/replacing-credit-ratings-in-financial-regulation/ “The Office of Financial Research (OFR) brief describes how financial regulators have replaced credit ratings. Most commonly, regulators now define what could make a security creditworthy. In other cases, they give companies regulatory models to use instead of credit ratings. Regulators also rely on third parties other than NRSROs to set credit standards.”

- Negative interest rates require flexibility in fixed income https://www.blackrockblog.com/2016/04/21/todays-bond-environment-4-charts/

- The Sub-Zero Club: Getting Used to the Upside-Down World Economy http://www.bloomberg.com/news/artic...getting-used-to-the-upside-down-world-economy

- Negative interest rates require flexibility in fixed income https://www.blackrockblog.com/2016/04/21/todays-bond-environment-4-charts/

- RIMS NeXtGen Summit https://www.rims.org/nextgensummit/2016/Pages/Agenda.aspx

- Get ready for R/Finance 2016 http://blog.revolutionanalytics.com/2016/04/get-ready-for-rfinance-2016.html Mentions that Robert McDonald (author of Derivatives Markets) has an R package for option pricing https://github.com/rmcd1024/derivmkts

- Brilliant added a section on Quantitative Finance, I am excited to check out their problems! https://brilliant.org/economics/quantitative-finance/

- How to Use Math Words to Sound Smart https://medium.com/conquering-corpo...h-words-to-sound-smart-7391a5166e1#.xafiigsq4

Last edited: