FRM Exam (week of April 4th)

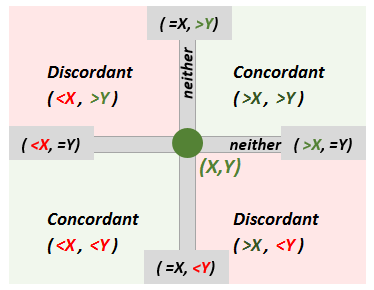

- Concordant versus discordant pairs

- There is a mistake in Meissner https://forum.bionicturtle.com/threads/kendalls-t-which-is-correct.9447/ Here is the detail, including Meissner's confirmation http://trtl.bz/Meissner-Kendall-mistake

- My visual explanation of concordant versus discordant http://trtl.bz/concordante-visual

- GARP Practice Exam P2.68 Component and marginal VaR https://forum.bionicturtle.com/threads/garp-2016-practice-exam-q68.9450/

- GARP (older) question on liquidity VaR (LVaR) https://forum.bionicturtle.com/threads/p2-focus-review-problem.9435/

- @bpdulog finds an clever way to infer the zero rate from the discount factor without using a formula https://forum.bionicturtle.com/threads/p1-t4-12-spot-rates.4909/page-2#post-41181;

i.e., if d(1.5) = 0.9809, then you can use calculator to retrieve semi-annual yield of 1.290% with: PV=-.9809, FV=1, PMT=0, N=3 and CPT I/Y=.6449*2 = 1.2898. - @bpdulog also asked "What are the actual days from 2/15/2014 to 7/1/2014?" (what's your answer?) and it stumped me like an optical illusion https://forum.bionicturtle.com/threads/p1-t4-311-accrued-interest.6873/#post-41180

- pdf vs inverse CDF https://forum.bionicturtle.com/thre...nverse-cumulative-distribution-function.9438/

- CML vs SML: https://forum.bionicturtle.com/threads/p1-t1-58-portfolio-possibilities-curve.5228/#post-41205

- All points (portfolios) on the CML are efficient, its slope is the Sharpe ratio of the market portfolio (which is on the CML, by definition)

- All points (portfolios) on the SML have the same Treynor ratio as the market portfolio, but they are not all necessarily efficient

- Three ways to get the bond price https://forum.bionicturtle.com/threads/p1-t3-504-bond-indenture-and-interest-payments.8831/

- KR01 volatility, difficult! https://forum.bionicturtle.com/threads/l2-t5-39-key-rate-volatility.3488/#post-41287

- Normal mixture distribution https://forum.bionicturtle.com/threads/mixture-distribution.9440/

- Here is Carol’s XLS which easily explores the flexibility of the normal mixture distribution http://trtl.bz/mra-vol1-normal-mixture

- @brian.field asks if there is an error in Meissner’s text https://forum.bionicturtle.com/threads/error-in-meissner-text.9137/

- @brian.field shares https://forum.bionicturtle.com/threads/statistical-pattern-recognition-jain-duin-and-mao.9456/

- Two simple spreadseeets

- A simple spreadsheet that computes par yield: Discussion here https://forum.bionicturtle.com/thre...onsumption-commodities.4534/page-2#post-41325 and XLS here http://trtl.bz/par-yield-annual-versus-sa

- A simple spreadsheet that scales lognormal VaR, see https://forum.bionicturtle.com/threads/lognormal-var.1597/#post-41347

- Expected shortfall: I added a tabulation (and its XLS) to the answer of T4.411.3, see https://forum.bionicturtle.com/threads/p1-t4-411-expected-shortfall-es.8075/

- Talking with @Mkaim about how exactly equity holders are paid after the overcollateralization (OC)in Malz three-tiered securitization https://forum.bionicturtle.com/thre...ritization-structure-cashflows-malz-9-2.7013/ I shared the XLS I developed here @ http://trtl.bz/T6-313-1-Malz-Table-9-1

- GARP and BIS

- GARP’s Risk Intelligence page has been redesigned http://www.garp.org/#!/risk-intelligence

- Revisions to the Basel III leverage ratio framework - consultative document http://www.bis.org/bcbs/publ/d365.htm

- Panama papers

- The Panama Papers: Here’s What We Know http://www.nytimes.com/2016/04/05/world/panama-papers-explainer.html

- I liked this summary, too http://trtl.bz/panama-101

- The Geography of Financial Secrecy http://www.theatlantic.com/international/archive/2016/04/panama-papers-tax-havens-world/477042/

- What the Panama Papers tell us about the challenges behind identifying the Ultimate Beneficial Owner http://blog.financial.thomsonreuter...behind-identifying-ultimate-beneficial-owner/

- Statistics (including two great blogs by The 20% Statistician)

- One-sided tests: Efficient and Underused http://daniellakens.blogspot.nl/2016/03/one-sided-tests-efficient-and-underused.html

- One-sided F-tests and halving p-values http://daniellakens.blogspot.com/2016/04/one-sided-f-tests-and-halving-p-values.html

- Fascinating! How the Average Triumphed Over the Median http://priceonomics.com/how-the-average-triumphed-over-the-median/ “Yet the median has never surpassed the average in terms of popularity. This is most likely because of the special statistical properties of the average, and its relationship to the normal distribution.”

- Hedging

- CFA FAJ: Hedging Climate Risk http://trtl.bz/0316-faj-hedge-climate-risk “By investing in a decarbonized index, investors in effect are holding a free option on carbon.” And Earth Is Tipping Because of Climate Change http://www.scientificamerican.com/article/earth-is-tipping-because-of-climate-change1/

- How To Identify Foreign Exchange Risk (Week 1) https://www.linkedin.com/pulse/week-1-how-identify-foreign-exchange-risk-jeffrey-warner-cfa

- To Hedge or Not to Hedge (Week 2) https://www.linkedin.com/pulse/week-2-hedge-jeffrey-warner-cfa

- Fintech

- Technology Transforms How Insurers Calculate Risk http://www.nytimes.com/2016/04/07/b...y-transforms-how-insurers-calculate-risk.html From their special: Fintech's Power Grab (Dealbook) http://www.nytimes.com/spotlight/dealbook-special-section

- Opportunities In The Risk Business Abound As Insurance Is Ready For Disruption http://techcrunch.com/2016/02/02/op...-abound-as-insurance-is-ready-for-disruption/

- Time is money is equity is growth http://whoo.ps/2016/03/29/time-is-money-is-equity-is-growth “Now that a class of internet startups — Uber, AirBnb, Netflix/Amazon — have matured to the degree that they may now be considered incumbents, one path for continued growth may be bundling financial services and lending into their platforms. These are services that may have previously been fulfilled by investors or banks, but inasmuch as you view banks as middlemen for the exchange of money and equity, it’s clear that the new class of services enabled by the internet — taxis, home rentals, entertainment — carry some advantages in tightly coupling the services they offer with financing options.”

- People

- Millennial Employees Confound Big Banks http://www.wsj.com/articles/millennial-employees-confound-big-banks-1460126369

- More Than 40% of Student Borrowers Aren’t Making Payments http://www.wsj.com/articles/more-than-40-of-student-borrowers-arent-making-payments-1459971348

- DOL's New Fiduciary Rule

- DOL Fiduciary Rule: Though Complex It Moves Investment Advice Model in Right Direction (CFA blog) https://blogs.cfainstitute.org/mark...s-investment-advice-model-in-right-direction/

- What the new U.S. fiduciary rule means for you http://www.reuters.com/article/us-usa-broker-consumers-idUSKCN0X32OU

- U.S. Unveils Retirement-Savings Revamp, but With a Few Concessions to Industry http://www.wsj.com/articles/u-s-unv...with-a-few-concessions-to-industry-1459936802

- Other interesting

- Risk Modeling: The Past and the Future https://www.linkedin.com/pulse/risk-modeling-past-future-philip-s-renaud-ii-cpcu “Since the crisis, new model considerations include counterparty risk, funding liquidity, regime-switching and government guarantees.”

- [Interest rate parity in markets] Dude, Where’s My Yield? http://www.bloomberg.com/gadfly/art...gher-government-yields-run-into-currency-wall “Currency markets are incredibly efficient and they're increasingly correlated to benchmark bond rates in some developing nations. In other words, the generous 5.5 percent gain on South African government bonds this year would have been largely offset for Japanese investors by the 3.1 percent drop in the rand versus the yen.”

- [Valuation] Private equity’s mark-to-make-believe problem http://ftalphaville.ft.com/2016/04/06/2158293/private-equitys-mark-to-make-believe-problem/ “If it’s challenging to figure out what a thing is “worth” when some of the smartest people on the planet, armed with the fastest computers and the biggest datasets, are constantly discussing and betting on its value, it’s downright impossible for investment managers focused on illiquid assets to assess the value of anything they own until they exit their positions by selling to someone else.”

- Agriculture-Related Water Risks: Understanding the Threat https://blogs.cfainstitute.org/inve...related-water-risks-understanding-the-threat/ “Growing competition for water, climate variability, pollution from agricultural runoff, weak water management and regulation, and aging infrastructure all contribute to a water availability crisis that was recently named the top global risk in terms of impact by the World Economic Forum [WEF 2015 Report].” In their 2016 Global Risk Report, WEF ranked Water Crises as 9th in Likelihood and 3rd in Impact, see https://www.weforum.org/reports/the-global-risks-report-2016

- Interesting new public dataset http://datausa.io/ Article about it here http://www.nytimes.com/2016/04/05/technology/datausa-government-data.html, or here http://mentalfloss.com/article/78120/dive-public-records-data-visualization-website

- Great tutorial: Intuitive Machine Learning : Gradient Descent Simplified http://ucanalytics.com/blogs/intuitive-machine-learning-gradient-descent-simplified/

- Risk Modeling: The Past and the Future https://www.linkedin.com/pulse/risk-modeling-past-future-philip-s-renaud-ii-cpcu “Since the crisis, new model considerations include counterparty risk, funding liquidity, regime-switching and government guarantees.”

Last edited: