Welcome to another WIFE. Last week we added a new practice question (PQ) set for the Insurance chapter (P1.FMP-2) and a new PQ set for the Risk Monitoring chapter (P2.IM-7). Trying to be realistic, for the mortality table, I pulled actual projected 2021 period life tables from the Social Security administration at https://www.ssa.gov/. We received some truly thought-provoking questions last week. e.g. why would you use a stop-limit? Is put-call parity related to BSM? Thank you especially to @lushukai for a lengthy, valuable response and to @bollengc for identifying several errors and typos. Very much appreciated!

New Practice Question (PQ) sets

New Practice Question (PQ) sets

- P1.T3.21.3. Insurance companies https://trtl.bz/3wnh3Qu

- P2.T9.21.9. Risk monitoring https://trtl.bz/2Tsch5A

- [P1.T1] GARP's mistake has been often repeated but "EC= UL- EL" is incorrect (UL- EL is not meaningful) https://trtl.bz/3wl06X1

- [P1.T2] Every FRM candidate must understand the quantile function https://trtl.bz/3pOZYMR

- [P1.T2] Quantifying the error when there is omitted variable bias https://trtl.bz/3vmhVUn

- [P1.T2] Is a seasonal differenced series MA(1)? https://trtl.bz/3gk7ZGq

- [P1.T3] What's the point of a stop-limit? https://trtl.bz/3pSrWrk

- [P1.T3] Is put-call parity related to BSM? https://trtl.bz/3gicW2v

- [P1.T4] Are ESOs dilutive? https://trtl.bz/3vfnTX7

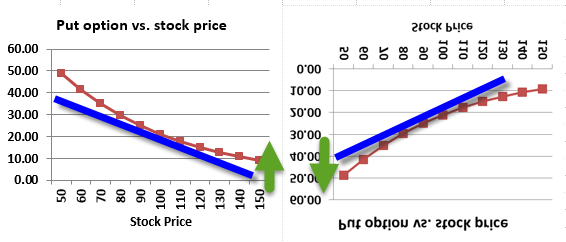

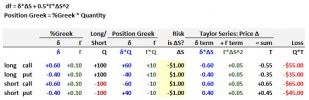

- [P1.T4] Thank you @lushukai for excellent response to math application of Taylor Series (delta-gamma) https://trtl.bz/35gNXX7

- [P1.T4] Thank you @bollengc for binomial https://trtl.bz/3gjfr4M and ex post/ex ante https://trtl.bz/3vllytI

- [P2.T7] When did Basel II come into force in the EU? https://trtl.bz/3pMX23o

- Risk, regulation and banking

- BCBS on prudential treatment of cryptoasset exposures https://www.bis.org/press/p210610.htm

- Assessing the Safety of Central Counterparties (Office of Financial Research) https://trtl.bz/3gu82hS Figure 1 is CCP default waterfall

- A Standard for Risk Data (ISDA) https://www.isda.org/2021/06/09/a-standard-for-risk-data/

- Assessing and addressing technology risk (Norman Marks) https://trtl.bz/3gusAqr "Understand the strategic plans and initiatives of the enterprise and then consider how technology is and will be used."

- Where is IFRS 9 taking the cost of funding of banks? https://trtl.bz/3zhMRrU

- LJM Fund Managers Face CFTC, SEC Charges; Chief Risk Officer Settles (GARP) https://trtl.bz/3vjSt1F[/U]

- Data, Tech, Cyber and DeFi

- Decentralized Finance: (DeFi) Policy-Maker Toolkit https://trtl.bz/3gsDZHy

- Blockchain and DeFI: Drivers of Change in Asset Management (notes from CFA's Alpha Summit) https://trtl.bz/3wlTNmb

- A survey into data governance tools (datacamp) https://trtl.bz/3cCwaxy

- Principles for Board Governance of Cyber Risk https://trtl.bz/3xkr8Os

- FinTech 3.0 Re-Architecting Financial Market Infrastructure & DeFi https://trtl.bz/3xj4WnD

- Survey on AI existential risk scenarios (LessWrong) https://trtl.bz/3cFwyeL

- ESG

- A Framework to Drive ESG Financial Discipline https://trtl.bz/2Sq2j4S "ESG isn’t non-financial information, but rather pre-financial information."

- The Next Frontier of Sustainable Investing (notes from CFA's Alpha Summit) https://trtl.bz/3zk4gAt

- BOE's financial risks from climate change (under three scenarios) https://trtl.bz/3gxrTNi

- Investing & Finance

- The Rise of SPACs: IPO Disruptors or Blank Check Distortions? (Aswath Damodaran) https://trtl.bz/35hocGd

- Director’s Guide to Shareholder Activism https://trtl.bz/3cBNFhO

- A visual explanation to short squeeze (FluentInFinance is reddit's best finance subreddit) https://trtl.bz/2Sw2DPs

- Should you be a short seller? https://www.alphaletter.co/p/should-you-be-a-short-seller

- Why Interest Rates Have to Stay Low For a Very Long Time (Ben Carlson) https://trtl.bz/3xkBoGa

- Still Using Book to Market for a Value Metric? https://trtl.bz/2SuYwmJ

- Reinventing the Financial System (Marc Rubinstein) https://trtl.bz/2TvW8Ms Links to: BOE's New forms of digital money https://www.bankofengland.co.uk/paper/2021/new-forms-of-digital-money

- Math

- Three simple things about regression that every data scientist should know https://trtl.bz/3pRnby7

- How Inevitable Is the Concept of Numbers? (by the incomparable Stephen Wolfram) https://trtl.bz/2TwnPoM

- Learning

- Coursera Global Skills Report 2021 https://trtl.bz/35kVvYU (pdf here)

- 7 Science-Backed Insights to Boost Your Meta-Learning (from Dr. Oakley's online course which I have myself taken and I loved it) https://trtl.bz/3pT6YbQ

- Other

- Negotiating Ransoms: When to Play and When to Fold https://trtl.bz/3gsEqSc interview with CEO of https://www.coveware.com/

- Visualizing Decentralization https://davidphelps.substack.com/p/visualizing-decentralization

Last edited: