alexwallace

Member

Hi David @David Harper CFA FRM

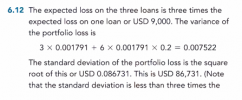

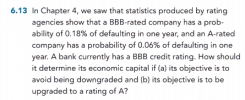

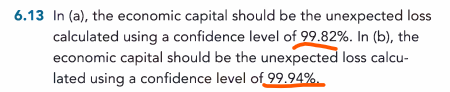

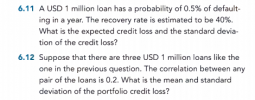

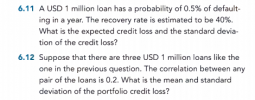

I came across the following exercise:

which has the solution

This is a simple question but one thing drove me mad (I do not exclude the opportunity my mind went blank due to being tired ) But anyway, I calculated variance in 6.11 as E(L^2) - {E(L)}^2 and

) But anyway, I calculated variance in 6.11 as E(L^2) - {E(L)}^2 and

E(L^2) = 0.995*0^2 + 0.005* { 1,000,000 * 0.6}^2

Then Variance = 1,791,000 ----------> st.dev = sqrt(1,791,000) = 42,320 ----> this part coincides with the answer an this is OK.

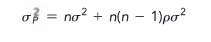

However, when I try to calculate portfolio variance with 3 similar loans I get:

Variance = 3*1,791,000 * {1 + 2*0.2} = 7,522,200 (and this also coincides with book , where it is 0.007522

But then I get a mismatch when I take the square out of this: in my case, sqrt(7,522,200) = 2742.67$

whereas sqrt(0.007522) = 0.086729.

There should be a mistake somewhere, but can not find it.

could you please help me?Thanks

I came across the following exercise:

which has the solution

This is a simple question but one thing drove me mad (I do not exclude the opportunity my mind went blank due to being tired

) But anyway, I calculated variance in 6.11 as E(L^2) - {E(L)}^2 and

) But anyway, I calculated variance in 6.11 as E(L^2) - {E(L)}^2 and E(L^2) = 0.995*0^2 + 0.005* { 1,000,000 * 0.6}^2

Then Variance = 1,791,000 ----------> st.dev = sqrt(1,791,000) = 42,320 ----> this part coincides with the answer an this is OK.

However, when I try to calculate portfolio variance with 3 similar loans I get:

Variance = 3*1,791,000 * {1 + 2*0.2} = 7,522,200 (and this also coincides with book , where it is 0.007522

But then I get a mismatch when I take the square out of this: in my case, sqrt(7,522,200) = 2742.67$

whereas sqrt(0.007522) = 0.086729.

There should be a mistake somewhere, but can not find it.

could you please help me?Thanks