It seems like there is a conflicting meaning of variation margin in the readings.

Thank you,

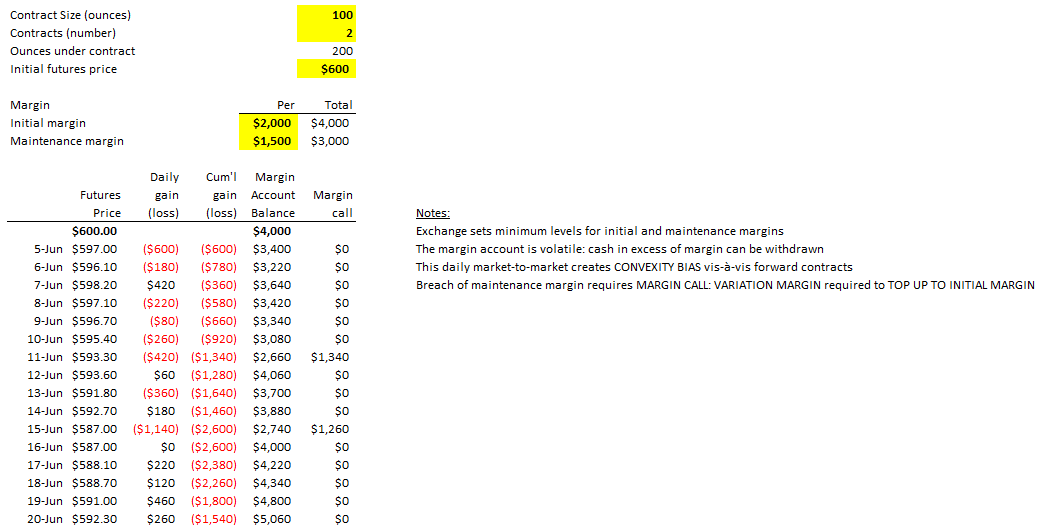

- The institute for Financial markets (page 21 in GARP FRM book) seems to indicate that the daily settlement of gains and losses refers to variation margin (so not only in case of a margin call)

- Hull Chapter 2: there is only a variation margin in case of a margin call

Thank you,