Priyanka_Chandak23

New Member

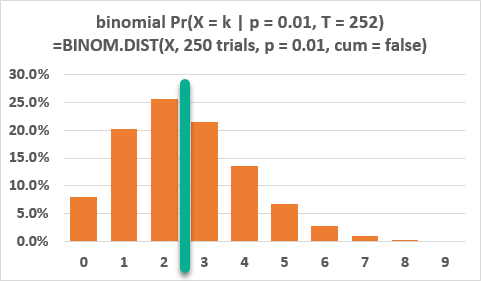

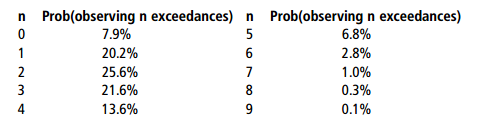

In 2006, UBS reported no exceedences on its daily 99% VaR. In 2007, UBS reported 29 exceedances. To test whether the VaR was biased, you consider using a binomial test. Assuming no serial correlation, 250 trading days, and an accurate VaR measure, you calculate the probability of observing n exceedances, for n = 0, 1, . . .

Which of the following statements is not correct?

a. At the 5% probability level, you cannot reject that the VaR was unbiased in 2006 using a binomial test.

b. The lack of exceedances in 2006 demonstrates that UBS failed to take into account the existence of fat tails in estimating the distribution of its market risk.

c. It is difficult to evaluate the implications of the lack of exceedances if the VaR is forecasted for a static portfolio and it is compared against the trading P&L.

d. At the 5% probability level, you can reject that the VaR was unbiased in 2007 using a binomial test.

Answer: b

Explanation: A and D are correct. Using 250 days in a year, the binomial test rejects for 2006 at the 8% level and for 2006 at less than the 1% level. C is correct since the trading P&L includes intra-day trading as well as market-making income. B is wrong since exceedances alone tell us nothing about the existence of fat tails.

GARP 2010

Could someone please explain point A and D correctness to me ? I am not being able to understand the binomial test here! Thanks.

Which of the following statements is not correct?

a. At the 5% probability level, you cannot reject that the VaR was unbiased in 2006 using a binomial test.

b. The lack of exceedances in 2006 demonstrates that UBS failed to take into account the existence of fat tails in estimating the distribution of its market risk.

c. It is difficult to evaluate the implications of the lack of exceedances if the VaR is forecasted for a static portfolio and it is compared against the trading P&L.

d. At the 5% probability level, you can reject that the VaR was unbiased in 2007 using a binomial test.

Answer: b

Explanation: A and D are correct. Using 250 days in a year, the binomial test rejects for 2006 at the 8% level and for 2006 at less than the 1% level. C is correct since the trading P&L includes intra-day trading as well as market-making income. B is wrong since exceedances alone tell us nothing about the existence of fat tails.

GARP 2010

Could someone please explain point A and D correctness to me ? I am not being able to understand the binomial test here! Thanks.

Last edited by a moderator: