You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

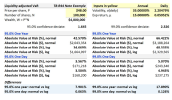

VaR calculation for Example of the LVAR p2.t8 page 6

- Thread starter JLafr0337

- Start date

Hi @JLafr0337 Exactly, "Absolute VaR" refers to worst expected loss relative to the initial position and so includes the drift: aVaR = -μ + σ*z. Also, it looks like that exhibit assumes T = 252 trading days. Thanks,

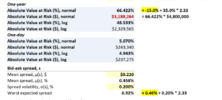

Hi @prianthar Yes that is correct. In market risk (what you are calling the book), "absolute VaR" as given by aVaR = -μ + σ*z has the positive drift offsetting the unexpected loss. But in liquidity VaR (LVaR) which adds the liquidity cost--if we are incorporating spread volatility--the "worst expected spread" adds a scaled (multiplied) spread volatility to the mean spread. That's because it's a different measure, but it's totally consistent with VaR: the adverse side of the distribution is a spread widening, not a spread narrowing! Thanks,

Similar threads

- Replies

- 0

- Views

- 101

- Replies

- 0

- Views

- 784

- Replies

- 0

- Views

- 1K

- Replies

- 0

- Views

- 1K