I am running through Level 1 FRM and doing ok but where I really struggle is using the calculator.

I have looked at tutorials online and cannot see much on the two questions below.

firstly I wanted to calculate the SMM, I am doing as follows

with a prepayment rate constant at 6%

CPR = 1 – (1 – SMM)12

And so,

SMM = 1 – (1 – CPR)1/12 = 1 – (1 – 0.006)1/12 = 0.0005014 = 0.05014%

I can do this in Excel and get the correct answer however, I only have a calculator in the Exam. when typing this in I cannot get back to the 0.0005014 answer. I try using Yx as either 1/12 or 0.0833 (1 over 12), I have also written it as 1 – (1 – 0.006)12 but still no luck.

what am I doing wrong?

In addition, I am trying to calculate the continuous compounding value of a portfolio.

portfolio value - $88m

yield - 4%

Duration - 5 years

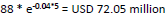

the calculation is 88 * -0.04*5 = USD 72.05 million ( ) but I cannot get back to the $72.05m. How would this be entered into the calculator?

) but I cannot get back to the $72.05m. How would this be entered into the calculator?

I hope the above makes sense!

If I master this then I am pretty much there for Book 3.

Thanks,

Martin

I have looked at tutorials online and cannot see much on the two questions below.

firstly I wanted to calculate the SMM, I am doing as follows

with a prepayment rate constant at 6%

CPR = 1 – (1 – SMM)12

And so,

SMM = 1 – (1 – CPR)1/12 = 1 – (1 – 0.006)1/12 = 0.0005014 = 0.05014%

I can do this in Excel and get the correct answer however, I only have a calculator in the Exam. when typing this in I cannot get back to the 0.0005014 answer. I try using Yx as either 1/12 or 0.0833 (1 over 12), I have also written it as 1 – (1 – 0.006)12 but still no luck.

what am I doing wrong?

In addition, I am trying to calculate the continuous compounding value of a portfolio.

portfolio value - $88m

yield - 4%

Duration - 5 years

the calculation is 88 * -0.04*5 = USD 72.05 million (

I hope the above makes sense!

If I master this then I am pretty much there for Book 3.

Thanks,

Martin