You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Types of collateral

- Thread starter AlexFrm

- Start date

-

- Tags

- collateral

Hi @AlexFrm see Gregory 6.5.3 below:

6.5.3 Collateral type:

Non-cash collateral also creates the problems of reuse or rehypothecation (Section 6.4.3) and additional volatility arising from the price uncertainty of collateral posted and its possible adverse correlation to the original exposure. On the contrary, cash is generally more costly to post and, in extreme market conditions, may be in limited supply.

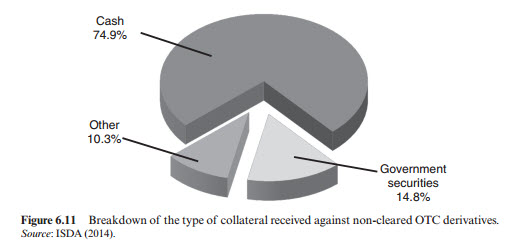

Cash is the major form of collateral taken against OTC derivatives exposures (Figure 6.11).

The ability to post other forms of collateral is often highly preferable for liquidity reasons. However, the global financial crisis provided stark evidence of the way in which collateral of apparent strong credit quality and liquidity can quickly become risky and illiquid (for example, Fannie Mae and Freddie Mac securities and triple-A mortgage backed securities). Cash collateral has become increasingly common over recent years, a trend that is unlikely to reverse – especially due to cash variation margin requirements in situations such as central clearing. Government securities comprise a further 14.8% of total collateral, with the remaining 10.3% comprising government agency securities, supranational bonds, US municipal bonds, covered bonds, corporate bonds, letters of credit and equities." -- Gregory, Jon. The xVA Challenge: Counterparty Credit Risk, Funding, Collateral, and Capital (The Wiley Finance Series) (p. 92). Wiley. Kindle Edition.

Similar threads

- Replies

- 0

- Views

- 60

- Replies

- 0

- Views

- 173

- Replies

- 0

- Views

- 171

- Replies

- 0

- Views

- 197