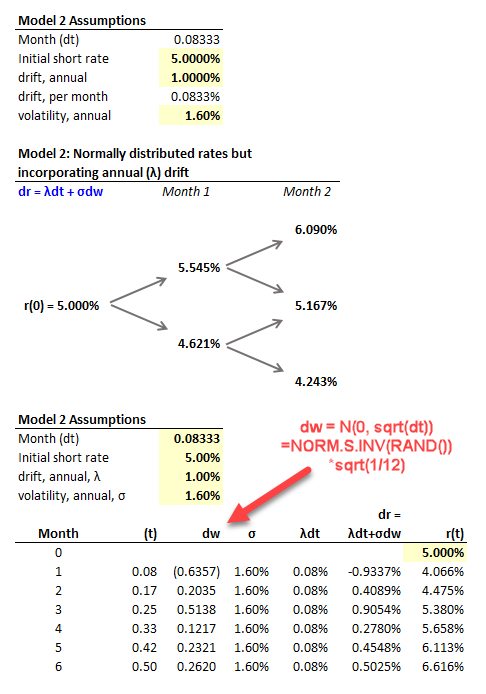

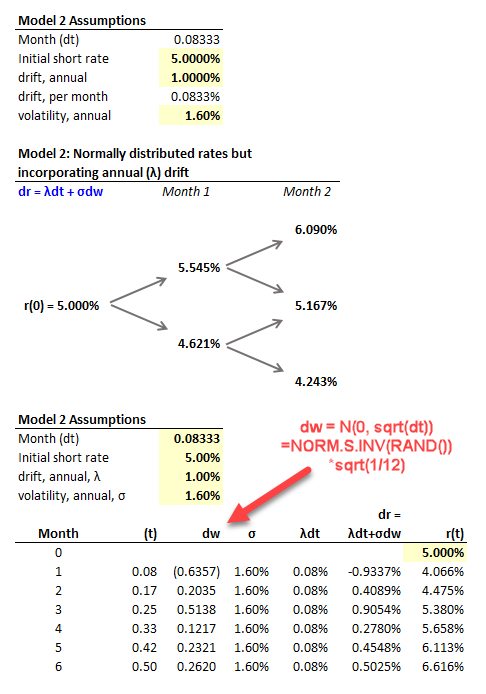

Hi David. A question from reading reading 40 on P2.T5, page 42. The table regarding Model 2; Simulation, the annual drift is converted into a monthly drift by dividing by 12. However, the annual volatility is not converted into monthly volatility. Page 43 is saying that the annual volatility should be multiplied by SQRT (1/12) to get the monthly volatility. Is this because the dw is already time-scaled?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tuckman: Model 2: Simulation

- Thread starter CarlosB

- Start date

Hi

When annual volatility is multiplied by SQRT (1/12) to get the monthly volatility its equivalent to saying that the annual volatility is converted into a monthly volatility by dividing by SQRT(12).So we time scale the annual volatility by SQRT (1/12) to get monthly volatility.

thanks

When annual volatility is multiplied by SQRT (1/12) to get the monthly volatility its equivalent to saying that the annual volatility is converted into a monthly volatility by dividing by SQRT(12).So we time scale the annual volatility by SQRT (1/12) to get monthly volatility.

thanks

Hi @CarlosB Yes, dw is random standard normal but it is already time-scaled. If you'd like to see it in action, here is the underlylng XLS (simulations will differ of course): https://www.dropbox.com/s/x77nvpb0tblxrv1/1102-tuckman-model-2.xlsx?dl=0

(see snapshot below also)

And from Tuckman (emphasis mine):

(see snapshot below also)

And from Tuckman (emphasis mine):

"The particularly simple model of this section will be called Model 1. The continuously compounded, instantaneous rate r(t) is assumed to evolve according to the following equation: (9.1)

dr = σ *dw

The quantity dr denotes the change in the rate over a small time interval, dt, measured in years; σ denotes the annual basis-point volatility of rate changes; and dw denotes a normally distributed random variable with a mean of zero and a standard deviation of sqrt(dt)." -- Tuckman, Bruce; Serrat, Angel. Fixed Income Securities: Tools for Today's Markets (Wiley Finance) (p. 251). Wiley. Kindle Edition.

Similar threads

- Replies

- 0

- Views

- 321

- Replies

- 0

- Views

- 455

- Replies

- 0

- Views

- 265

- Replies

- 0

- Views

- 783

- Replies

- 0

- Views

- 471