Hi @David Harper CFA FRM I found in your earlier post that intuition for theta to be +ve for ITM Put option as below:

"if you hold a deep ITM put, with asset price near zero, more "waiting time" to the Euro expiration is not a good thing, asset price can't go below zero. Volatility has asymmetric effect: mostly works against you to increase asset price/decrease put. You want to expire as soon as possible"

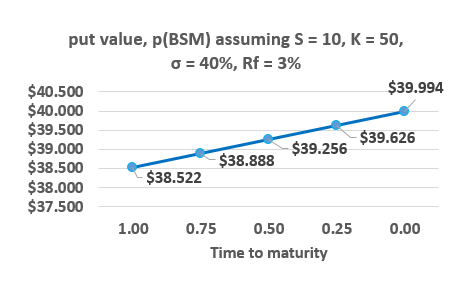

I'm still not getting why put value will increase i.e theta is +ve as we approach option expiry here?

Is there any illustration you can refer please ?

"if you hold a deep ITM put, with asset price near zero, more "waiting time" to the Euro expiration is not a good thing, asset price can't go below zero. Volatility has asymmetric effect: mostly works against you to increase asset price/decrease put. You want to expire as soon as possible"

I'm still not getting why put value will increase i.e theta is +ve as we approach option expiry here?

Is there any illustration you can refer please ?