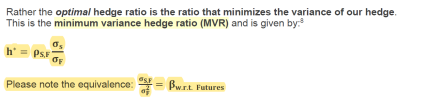

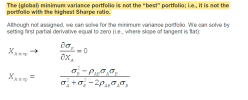

The minimum variance hedge is based on the slope of the regression line. If we use the number of contracts implied by the minimum variance hedge ratio, then we are minimizing the volatility of the net position (i.e., the portfolio that consists of the exposure plus the hedge).

David's XLS is here: https://www.dropbox.com/s/qyd9j5n9i3z0ptx/031418-mvh.xlsx?st=dtgcafhz&dl=0

David's XLS is here: https://www.dropbox.com/s/qyd9j5n9i3z0ptx/031418-mvh.xlsx?st=dtgcafhz&dl=0

Last edited: