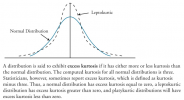

Kurtosis is the standardized fourth central moment and is a measure of tail density; e.g., heavy or fat-tails. Heavy-tailedness also tends to correspond to high peakedness. Excess kurtosis (aka, leptokurtosis) is given by (kurtosis-3). We subtract three because the normal distribution has kurtosis of three; in this way, kurtosis implicitly compares to the normal distribution and "positive excess kurtosis" means "tails are heavier than the normal" or "extreme outcomes are MORE likely than under the normal."

Here is David's XLS: http://trtl.bz/121817-yt-kurtosis-xls

Here is David's XLS: http://trtl.bz/121817-yt-kurtosis-xls

. I really appreciate it!

. I really appreciate it!