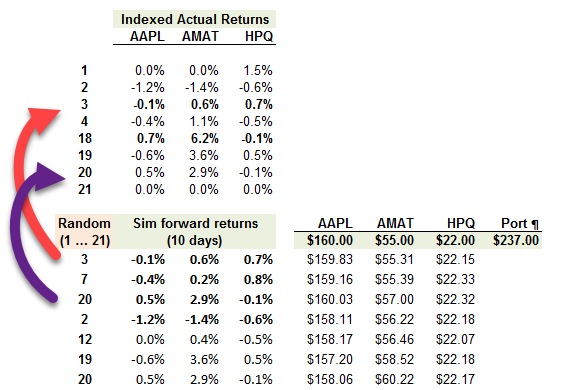

The key idea of Boostrap HS is "sampling with replacement:" we randomly retrieve ACTUAL daily returns and use them to simulate forward.

Here is David's XLS: http://trtl.bz/2yzTYPM

Here is David's XLS: http://trtl.bz/2yzTYPM

Last edited: