GavinInsight

New Member

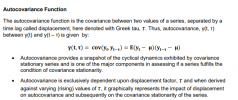

As title suggests , i am seeing many references to displacement in notes but am struggling to understand it in the context of the chapter. I think it has to do with the difference in the observed value today (t) vs the observed value x number of days ago (T-x). Is that right? I couldn't find this explained elsewhere in the forums