Hi David,

If a bank retains the equity tranche of a securitization where the notional of the tranche is $10 mio and the tranche has a long term B- credit rating, what is the capital charge under the SA for securitization exposures?

a- $400,000

b- $800,000

c- $1.2 mio

d- $10 mio

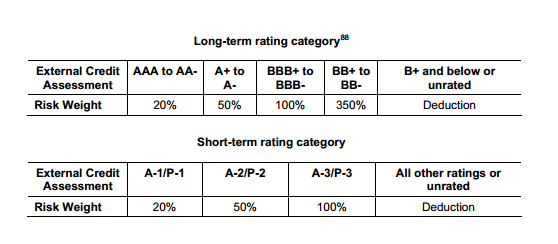

Your answer was $10 mio: B+ and below rated securitizations are DEDUCTED while implies risk weight such that CRC = $10 mio * 12.8 * 8% = $10 mio.

My argument: As per Basel, only unrated assets will be subject to deduction. Since the tranche is rated B-, a RWA of 150% should apply....please verify!

Thanks

Imad

If a bank retains the equity tranche of a securitization where the notional of the tranche is $10 mio and the tranche has a long term B- credit rating, what is the capital charge under the SA for securitization exposures?

a- $400,000

b- $800,000

c- $1.2 mio

d- $10 mio

Your answer was $10 mio: B+ and below rated securitizations are DEDUCTED while implies risk weight such that CRC = $10 mio * 12.8 * 8% = $10 mio.

My argument: As per Basel, only unrated assets will be subject to deduction. Since the tranche is rated B-, a RWA of 150% should apply....please verify!

Thanks

Imad