saurabhpal49

New Member

Hi David ,

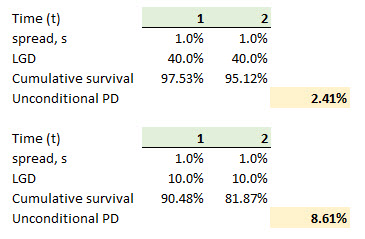

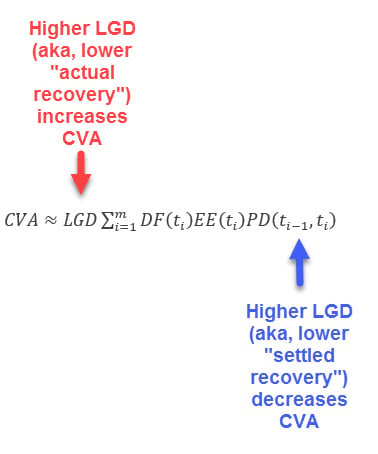

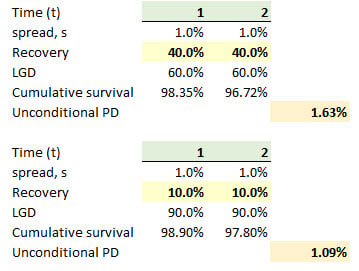

Could you please explain the difference between settled and actual recovery rates,with an example

And why does 10% settled and 40% actual recovery has low cva compared to 40% of both

Thanks

Could you please explain the difference between settled and actual recovery rates,with an example

And why does 10% settled and 40% actual recovery has low cva compared to 40% of both

Thanks