Hello,

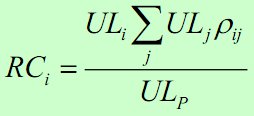

In the notes (and video) you state that if there is no correlation between assets then the addition of that asset will lead to zero risk contribution. I do not think this is correct, at least from a simple mathematical standpoint. UL(1)=30 and UL(2)=40. UL port if rho=0 is sqrt (900+1600)=sqrt(2500)=50. Both components still have risk contributions even though they have zero correlation.

Maybe there is a terminology mistake somewhere. Maybe you meant that the idiosyncratic UL is zero if rho=0? Not 100% sure about that either, but the idea sounds right.

Thanks!

Shannon

In the notes (and video) you state that if there is no correlation between assets then the addition of that asset will lead to zero risk contribution. I do not think this is correct, at least from a simple mathematical standpoint. UL(1)=30 and UL(2)=40. UL port if rho=0 is sqrt (900+1600)=sqrt(2500)=50. Both components still have risk contributions even though they have zero correlation.

Maybe there is a terminology mistake somewhere. Maybe you meant that the idiosyncratic UL is zero if rho=0? Not 100% sure about that either, but the idea sounds right.

Thanks!

Shannon

As you example demonstrates or, if you enter zero (0) into default correlation in

As you example demonstrates or, if you enter zero (0) into default correlation in