Arka Bose

Active Member

Hi @David Harper CFA FRM and all,

This is not related to FRM, but still concept applies, so I am asking here. In the CFA L3 textbook, this para is given:

"In general, for an upward-sloping yield curve, the immunization target rate of return will be less than the yield to maturity because of the lower reinvestment return. Conversely, a negative or downward-sloping yield curve will result in an immunization target rate of return greater than the yield to maturity because of the higher reinvestment return."

In the glossary: "the immunization target rate of return is defined as “the assured rate of return of an immunized portfolio, equal to the total return of the portfolio assuming no change in the term structure.”

Can anyone tell me why in an upward sloping term structure, the reinvestment rate is lower?

I have tried finding similar in Bruce Tuckman's book but no luck.

Thanks in advance

This is not related to FRM, but still concept applies, so I am asking here. In the CFA L3 textbook, this para is given:

"In general, for an upward-sloping yield curve, the immunization target rate of return will be less than the yield to maturity because of the lower reinvestment return. Conversely, a negative or downward-sloping yield curve will result in an immunization target rate of return greater than the yield to maturity because of the higher reinvestment return."

In the glossary: "the immunization target rate of return is defined as “the assured rate of return of an immunized portfolio, equal to the total return of the portfolio assuming no change in the term structure.”

Can anyone tell me why in an upward sloping term structure, the reinvestment rate is lower?

I have tried finding similar in Bruce Tuckman's book but no luck.

Thanks in advance

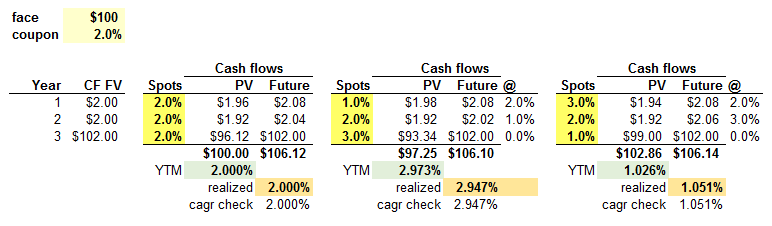

but I think I get it. My understanding is reflected in this tiny XLS

but I think I get it. My understanding is reflected in this tiny XLS