gargi.adhikari

Active Member

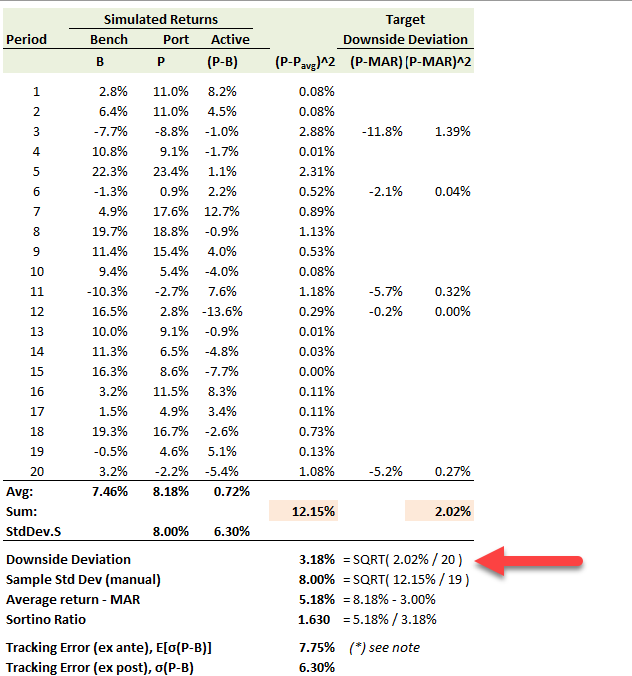

In reference to R8.P1.T1.Amenc_Ch4_RISK_MGMT_Topic: SORTINO_RATIO_DOWNSIDE_DEVIATION_FORMULA:-

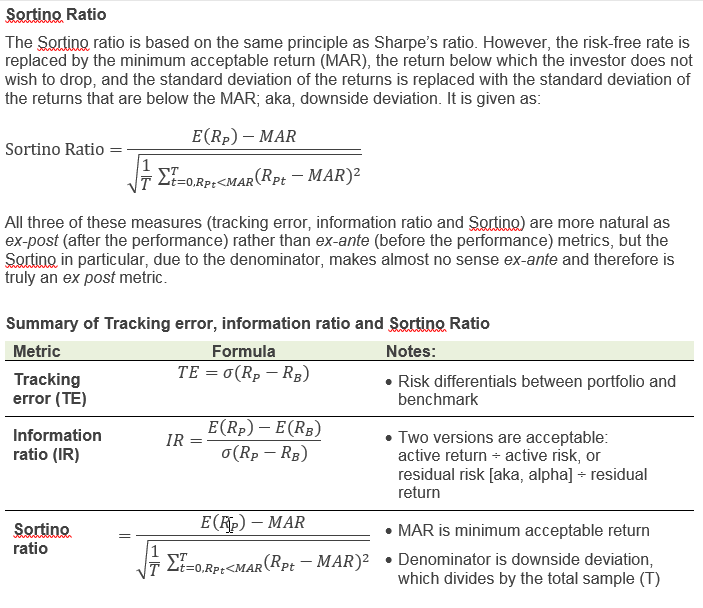

The Formula for Sortino Ratio = ( Average PortFolio Return - MAR ) / Downside Deviation

where Downside Deviation should be = SQRT[ ( {Portfolio Return - MAR ) ^ 2 } / N ]

instead of (1/ N ) * SQRT[ ( {Portfolio Return - MAR ) ^ 2 } ] ....?

The associated Learning spreadsheet for Amenc Ch4 also calculates the Downside Deviation as

(1/ N ) * SQRT[ ( {Portfolio Return - MAR ) ^ 2 } ] .....

Please confirm the correct version... Much gratitude.

The Formula for Sortino Ratio = ( Average PortFolio Return - MAR ) / Downside Deviation

where Downside Deviation should be = SQRT[ ( {Portfolio Return - MAR ) ^ 2 } / N ]

instead of (1/ N ) * SQRT[ ( {Portfolio Return - MAR ) ^ 2 } ] ....?

The associated Learning spreadsheet for Amenc Ch4 also calculates the Downside Deviation as

(1/ N ) * SQRT[ ( {Portfolio Return - MAR ) ^ 2 } ] .....

Please confirm the correct version... Much gratitude.

so please feel free to further disagree. Thank you for your attention to detail, and apologies for the confusion, thanks!

so please feel free to further disagree. Thank you for your attention to detail, and apologies for the confusion, thanks!