gargi.adhikari

Active Member

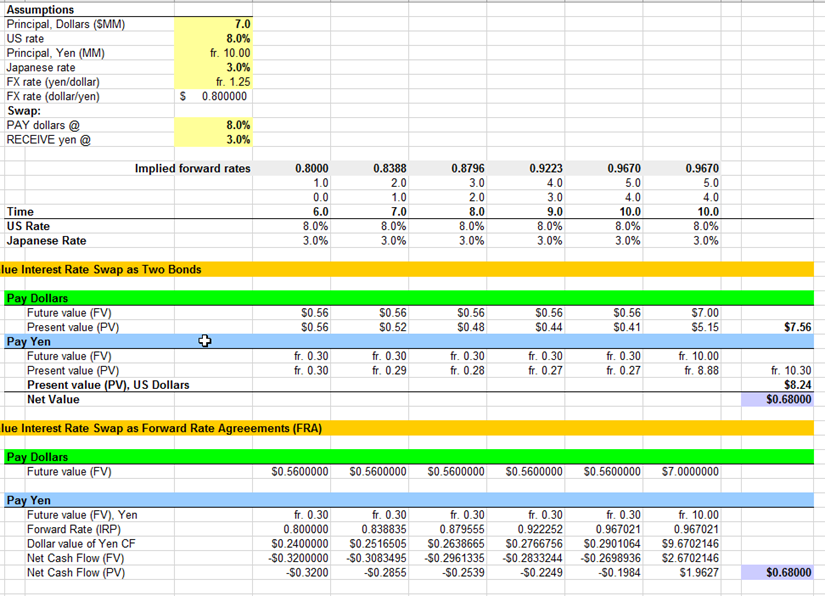

In reference to R19.P1.T3.FIN_PRODS_HULL_Ch7_Currency_Swap_Valuation

Eg2:-

Currency Swap Valuation -Eg 1 in the prior tab is perfectly good. But I had some questions on the 2nd Example for the Currency Swap Valuation. I see 2 different Net Swap Values for the 2 methodologies - $ 2.71 in the Bond Methodology and $ .6121 in the FRA Method. Also, in The Bond method, the valuation is just for Time = 10...where are the other years..? Why are we not factoring them in..?

Also why are the Time values Row 16 ( F16 to K16 ) = Row 17 ( F17 to K17 ) - 5 ...?

Much gratitude.

Eg2:-

Currency Swap Valuation -Eg 1 in the prior tab is perfectly good. But I had some questions on the 2nd Example for the Currency Swap Valuation. I see 2 different Net Swap Values for the 2 methodologies - $ 2.71 in the Bond Methodology and $ .6121 in the FRA Method. Also, in The Bond method, the valuation is just for Time = 10...where are the other years..? Why are we not factoring them in..?

Also why are the Time values Row 16 ( F16 to K16 ) = Row 17 ( F17 to K17 ) - 5 ...?

Much gratitude.

Attachments

Last edited:

I probably need to remove this sheet or clean it up. I finally discovered it was my hasty attempt to answer Hull's Question 7.12, which I probably should not have shared to the learning XLS. Here is Hull's question which I was attempting to answer:

I probably need to remove this sheet or clean it up. I finally discovered it was my hasty attempt to answer Hull's Question 7.12, which I probably should not have shared to the learning XLS. Here is Hull's question which I was attempting to answer:

Will dig back into this one shortly

Will dig back into this one shortly