gargi.adhikari

Active Member

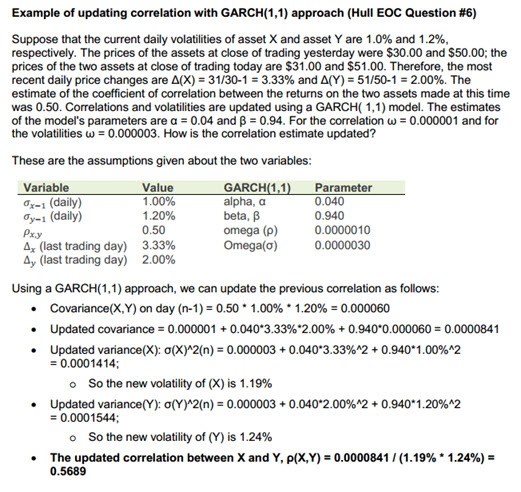

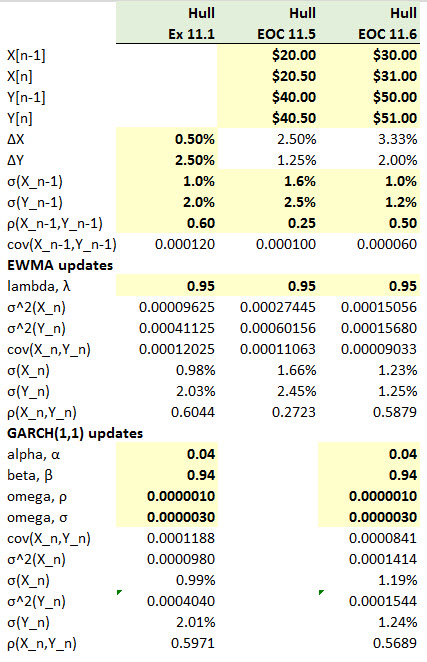

In Reference to R16.P1.T2.HULL_CH11_TOPIC:UPDATED_CORRELATION_using_GARCH :-

Hi,

I have a couple of questions on this problem statement illustrated below:-

1) Omega (Correlation ) = .000001 This Omega is for the Correlation.Why are we using the same coefficient for the Covariance as well..?

2) The Volatilities for X & Y are given to be 1% and 2% - these are yesterday's or (n-1) day's Volatilities. But the problem statement says these are the 'Current' Volatilities. By 'Current' , i tend to think it's for today for for the 'n'-th day....

3) I have a similar issue with the Correlation Coefficient. The Problem statement says .5 is the " Correlation Coefficient " "at this time" - it is unclear whether this is for n or for (n-1)....

Would we have similar verbiage in the exam..if so, then I will train my brain to interpret that way....

Hi,

I have a couple of questions on this problem statement illustrated below:-

1) Omega (Correlation ) = .000001 This Omega is for the Correlation.Why are we using the same coefficient for the Covariance as well..?

2) The Volatilities for X & Y are given to be 1% and 2% - these are yesterday's or (n-1) day's Volatilities. But the problem statement says these are the 'Current' Volatilities. By 'Current' , i tend to think it's for today for for the 'n'-th day....

3) I have a similar issue with the Correlation Coefficient. The Problem statement says .5 is the " Correlation Coefficient " "at this time" - it is unclear whether this is for n or for (n-1)....

Would we have similar verbiage in the exam..if so, then I will train my brain to interpret that way....