I have a question on Credit Risk Study Note Page 90.

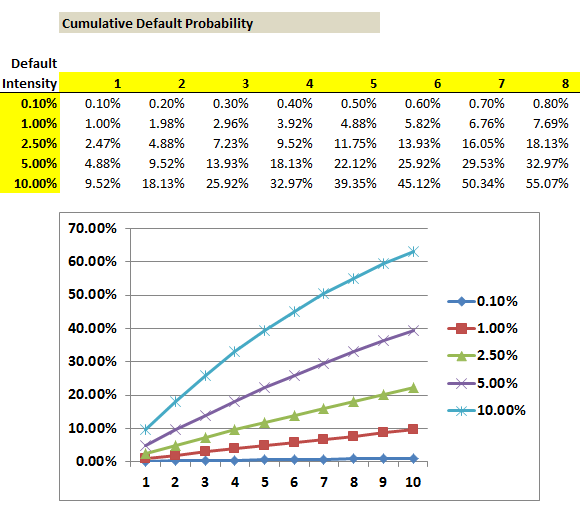

Marginal default probability = lambda*exp(-lambda*t).

Under the formula, it says that "This is always a positive number, since default risk "accumulates", i.e. the probability of default increases for longer horizons. If lambda is small, it will increase at a very slow pace."

I don't understand "This is always a positive number, since default risk "accumulates", i.e. the probability of default increases for longer horizons. If lambda is small, it will increase at a very slow pace."

What I understand: marginal default probability is a decreasing function of t, is it right? If lambda is small, marginal default probability will decrease at a slow pace?

Marginal default probability = lambda*exp(-lambda*t).

Under the formula, it says that "This is always a positive number, since default risk "accumulates", i.e. the probability of default increases for longer horizons. If lambda is small, it will increase at a very slow pace."

I don't understand "This is always a positive number, since default risk "accumulates", i.e. the probability of default increases for longer horizons. If lambda is small, it will increase at a very slow pace."

What I understand: marginal default probability is a decreasing function of t, is it right? If lambda is small, marginal default probability will decrease at a slow pace?