emilioalzamora1

Well-Known Member

Hi David,

I am referring to Dowd's footnote:

'HS fails to take account of useful information from the upper tail of the P/L distribution. If the stock experiences a series of large falls, then a position that was long the market would experience large losses that should show up, albeit later, in HS risk estimates'

Can someone please explain what is meant by 'upper tail of the P/L'? (perhaps incl. a graphic) and why after a large loss does this loss only show after some time has elapsed in HS?

Thank you!

I am referring to Dowd's footnote:

'HS fails to take account of useful information from the upper tail of the P/L distribution. If the stock experiences a series of large falls, then a position that was long the market would experience large losses that should show up, albeit later, in HS risk estimates'

Can someone please explain what is meant by 'upper tail of the P/L'? (perhaps incl. a graphic) and why after a large loss does this loss only show after some time has elapsed in HS?

Thank you!

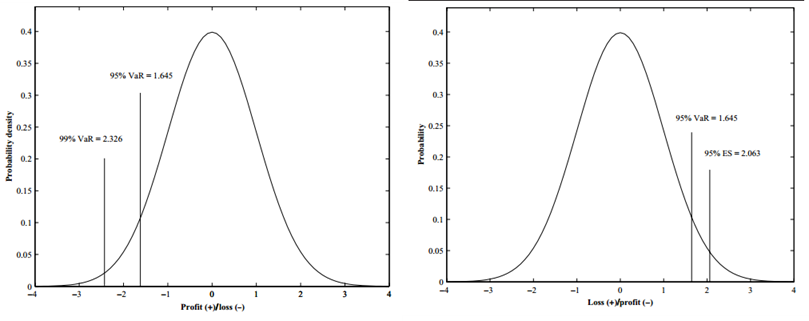

See image below, which is simply a paste of two of Dowd's images. On the left is "unaltered" math which he calls a P/L , wehre losses are negatives and VaR = -q; e.g., 95% VaR = -(-1.65) = 1.65. On the right, losses are positives and this is called L/P. In this way, the "upper tail of the P/L" refers to profits (or gains) which is the side of the distribution that VaR and ES don't directly measure. So hopefully in this context Dowd's first point is self-explanatory: volatility that spikes due to upside jumps (gains) will not translate into either VaR or ES because they measure the other tail. (and it's a short position that would experience loss in this jump). I attached the referenced paper, FYI (relevant text extracted below)

See image below, which is simply a paste of two of Dowd's images. On the left is "unaltered" math which he calls a P/L , wehre losses are negatives and VaR = -q; e.g., 95% VaR = -(-1.65) = 1.65. On the right, losses are positives and this is called L/P. In this way, the "upper tail of the P/L" refers to profits (or gains) which is the side of the distribution that VaR and ES don't directly measure. So hopefully in this context Dowd's first point is self-explanatory: volatility that spikes due to upside jumps (gains) will not translate into either VaR or ES because they measure the other tail. (and it's a short position that would experience loss in this jump). I attached the referenced paper, FYI (relevant text extracted below)

, thank you. Exactly as you show, my suspiciously convenient dataset did contemplate:

, thank you. Exactly as you show, my suspiciously convenient dataset did contemplate: